Where else would a crazy idea like this come from?

The unions supporting the 2026 ballot initiative say their billionaires tax would help prop up the state’s “collapsing health care and education systems.” California is already the highest tax state, but faced a $12 billion deficit at the start of the year.

Emmanuel Saez, an economics professor at UC Berkeley and the brainchild of the proposal (he has supported a 70% federal income tax rate), says that there would be no way for the rich to get around paying the tax because it would be retroactive to 2025. Retroactive taxes are usually ruled unconstitutional “takings of property,” but Lord knows what the courts in California would decide.

But billionaires generally aren’t stupid, so how many would stick around for the next round of wealth taxes?

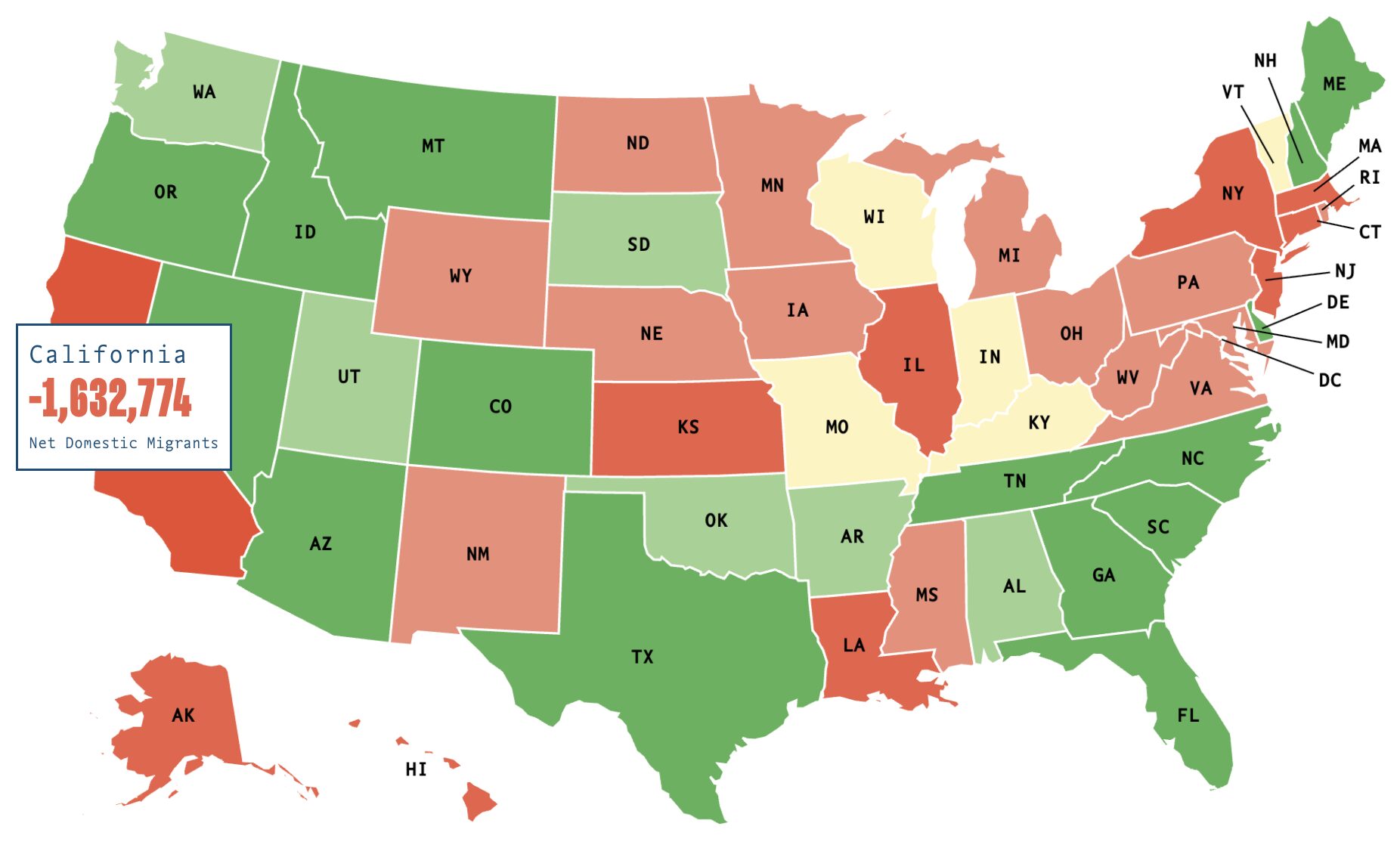

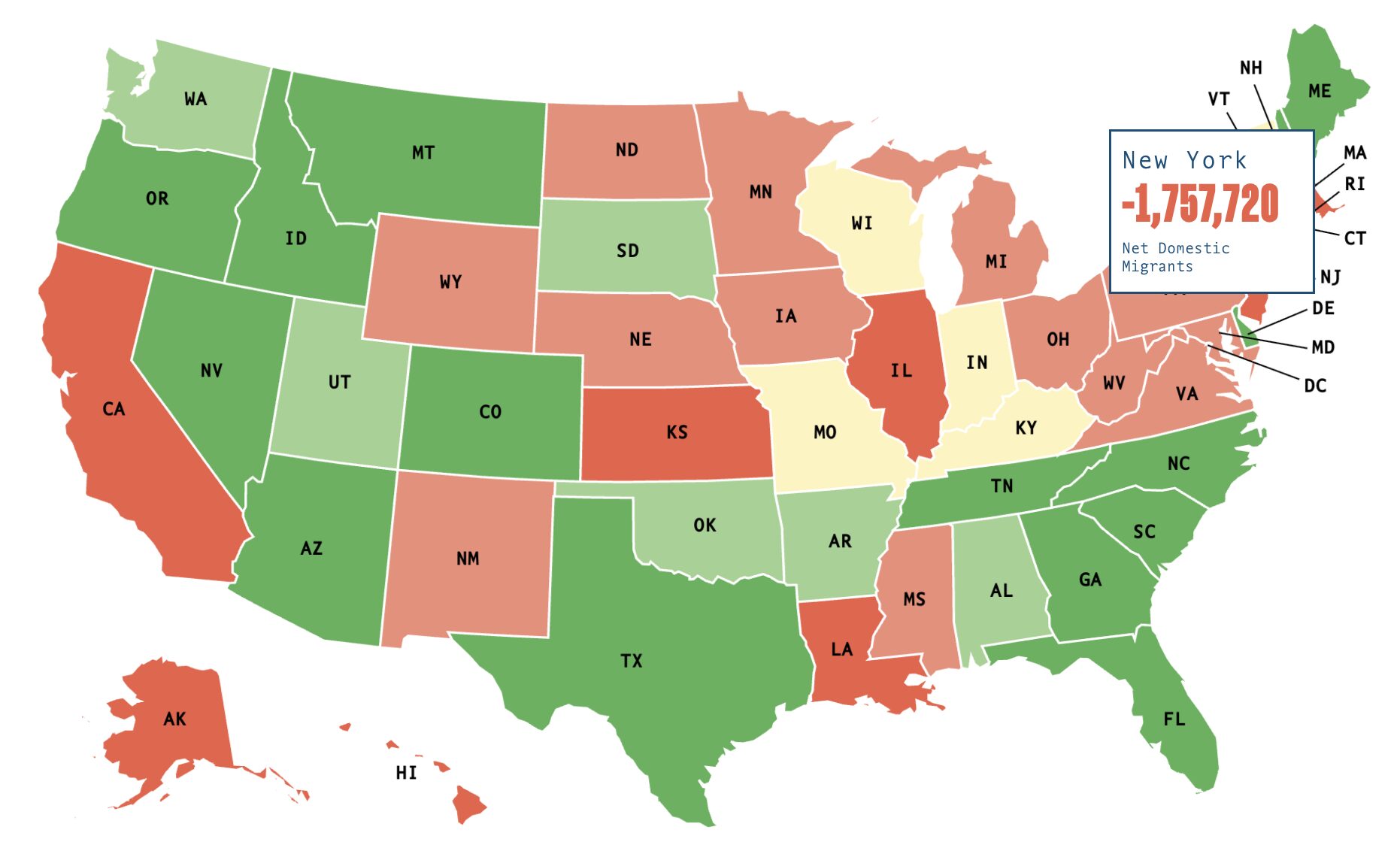

California and New York are in a race to see which state can raise taxes the most, so it is no surprise that these two states have lost close to four million residents over the past decade.