Netflix is, of course, the N company in the super-tech quintet of FAANG titans – which also includes Facebook, Amazon, Apple, and Google.

Netflix’s stock has gotten crushed this week. Just flattened.

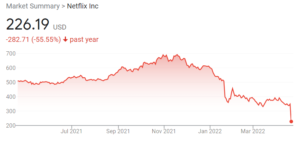

Its share price collapsed by 35% in one day – one of the biggest single-day sell-off in the history of stocks. For now the rout doesn’t seem to be abating. Over the past year Netflix market cap has tumbled from $650 billion to now close to $200 billion.

Sorry if you own this stock.

The Netflix brass blames its demise on “fierce competition” for subscribers.

What to make of all this?

These companies with at one time $6 trillion in market cap have all been attacked as monopolies in Washington and by state attorney generals. The “break-up high tech” howls have been as loud and persistent as ever this year. They come from the far left – Bernie Sanders and Amy Klobuchar – and some conservative Republicans like Josh Hawley as well.

We carry no water for big tech and are as frustrated with the free speech infringements against conservatives as anyone. But cries of “monopoly” are so early 20th century.

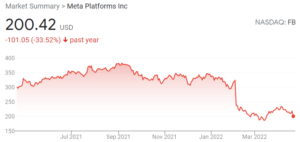

First we had Facebook’s plunge, and now the 60% collapse in Netflix’s stock, which is a painful reminder that there is no industry more hyper-competitive than the tech sector.

Watch out Google. If you slip up, the marauders are coming to drain your wealth next. Globalization and free trade have dramatically lowered prices of digital companies.

That is as it should be in a free-market capitalist world. One day you are on top of the world and seemingly in an impenetrable fortress – and the next you lose half your market cap. We don’t need trust-buster regulators in Washington – like the leftist Lina Khan of the FTC – policing our businesses. The market is doing that just fine, thank you.

Joseph Schumpeter called this process “creative destruction.” The Netflix sell off is a jolting reminder of the omnipresent and disruptive power of that concept.