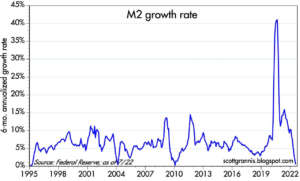

Our item yesterday pronouncing that inflation seems to be taming sparked a lively and even heated response from some of our readers. There seems to be no consensus. Arthur Laffer – our CTUP cofounder and a monetary expert – believes the inflation threat is still very real. He points to the enormous and nearly unprecedented $6.5 trillion rise in the quantity of money (M1) during the pandemic – money that still not been drained from the economy. The trillions of dollars of excess liquidity are still sloshing around out there.

That chart from Laffer Associates is shown below.

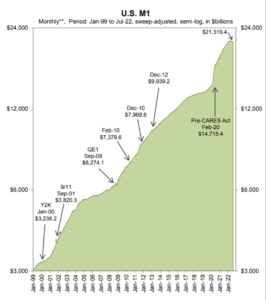

But then our friend Scott Grannis – also a long-time financial expert – sends to us this chart on the RATE OF CHANGE in the supply of money. The monetary base is still sky-high, but it isn’t growing anymore.

Our view isn’t that the inflation bogeyman has gone away, only that the inflation RATE is slowing and will continue to do so in the months ahead. But Laffer is of course right that the Fed has created many trillions of dollars of money over the past 30 months and there is still a LONG way to go to get back to the Fed’s target CPI rate of 2%.