A new paper by Stanford University Finance Professor Joshua Rauh finds:

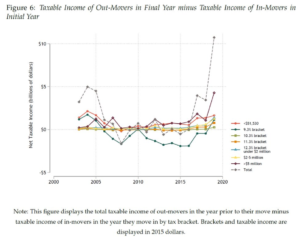

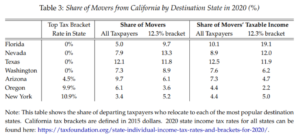

California’s top earners are particularly mobile, showing the highest rates of departure around tax policy changes such as Proposition 30 in 2012 and the Tax Cut and Jobs Act (TCJA) of 2017 as well as the COVID-19 pandemic in 2020. Consequently, potential net outflows of taxable income spiked to nearly $4 billion in the year TCJA was implemented and $10.7 billion around COVID-19. High-earning movers have been consistently more likely to leave California for zero-income tax states since 2012, and those who experienced larger tax increases under TCJA were more likely to depart. During the COVID-19 episode in 2020, changing patterns of destination states provide evidence that taxpayers were motivated by COVID restrictions as well. For families with dependents, the share of California taxpayers who left and moved to a given state was higher in 2020 by an average of half a percentage point for every 10 percent fewer days of school closures in the destination state.

Where did they go?

Gavin Newsom recently declared California the freedom state; we think the “freedom to leave state” is more accurate.