There are a lot of economic factors that affect the stock market other than a president’s economic/fiscal policies. Obama’s stock market performance was in large part because he took the Oval Office right when the Great Financial Crisis of 2008 was ending – so stocks surged to recover the deep losses from the Fall of 2008. Wild swings and corrections happen and sometimes we don’t even know why (i.e., the 1987 stock market crash).

But policies in Washington do impact asset and stock prices a lot. Axios recently compared the stock indices during Biden’s first 30 months in office, versus Trump’s.

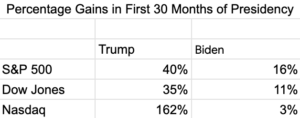

Here are the results: “All three major U.S. stock indices have increased during President Biden’s time in office, but the gains are smaller than those of his last two predecessors.”

Compared to Trump, here are the returns on the three major stock indices:

The tech sector LOVED Trump’s policies and has barely kept its head above water under Biden.

This means that if Biden had kept pace with Trump’s stock performance (and remember, we were coming out of Covid when Biden took office, so the market was primed for a bid rally) Americans would have two to five times the returns over the past two-and-a-half years on their 401k plans and other retirement savings.