Regular readers of the Hotline know we are fanatical advocates of the flat tax. Our co-founder, Steve Forbes, was the first major presidential candidate to run on the idea.

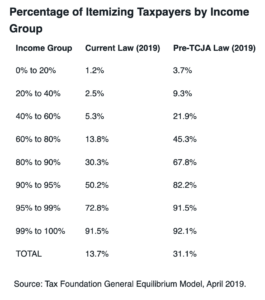

The case for the flat tax is stronger today than ever before, because of an often overlooked shrewd tax simplification feature of the Trump tax cut. That bill doubled the “check the box” standard deduction from $12,500 to $25,000 a year. As a consequence of this generous standard deduction, only a small percentage (13% of tax filers) itemize deductions on their tax filings, down from one-third before the Trump tax reforms.

The chart below shows that very few Americans except for the rich itemize deductions anymore. The major write-offs are those for mortgage interest, charitable contributions, and state and local taxes (which are now capped), and medical expenses.

Since for all intents and purposes, only the rich itemize, why not wipe out all deductions, and then lower the top tax rate to somewhere between 21 and 25%?

This would make taxes easy for all to calculate and increase economic growth by reducing the economic distortions of higher tax rates.

Why hasn’t this obvious solution happened? The answer is that this would risk putting tax accountants, lawyers, and IRS agents out of work. Would that be so bad?