The federal government has handed out roughly $50 billion of green energy handouts to the richest households over the last 20 years.

A new study by the Energy Institute at the Haas School of Business, University of California, Berkeley (no bastion of conservatism!) finds:

Over the last two decades, U.S. households have received $47 billion in tax credits for buying heat pumps, solar panels, electric vehicles, and other “clean energy” technologies. Using information from tax returns, we show that these tax credits have gone predominantly to higher-income households. The bottom three income quintiles have received about 10% of all credits, while the top quintile has received about 60%.

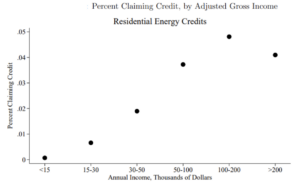

Here are the results for residential green energy – such as building solar panels:

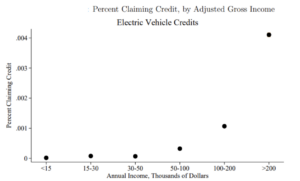

Even more biased in favor of mostly wealthy blue-state liberals is the tax credit for EVs. The higher the income, the more likely to get the tax break: “The most extreme is the tax credit for electric vehicles, for which the top quintile has received more than 80% of all credits, and the top 5% has received about 50%,” the study found.

We can’t just blame Biden for the green energy handouts. George W. Bush and Barack Obama both signed expensive green energy subsidy bills as well.

If Democrats are truly concerned about a fairer tax system and reducing inequality, why not start by eliminating the green energy carve outs for those at the top of the income ladder?