It’s a simple truism that uncertainty about the future is bad for growth and investment.

That’s why the “temporary” – rather than permanent – status of the Trump business tax cut is hampering growth. This message is amplified by a new survey of 500 senior business leaders conducted by Ernst & Young, which finds big economic gains from making the tax cuts permanent as soon as possible:

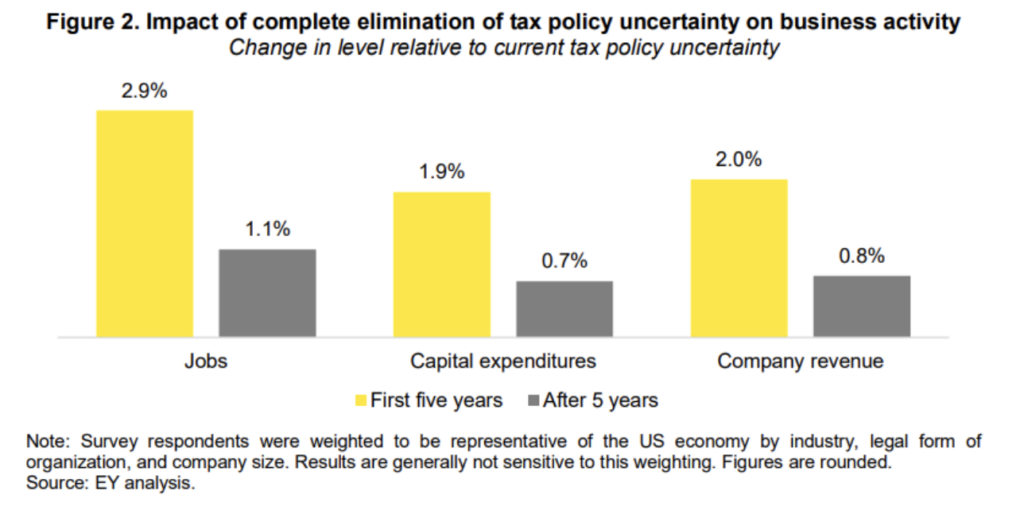

Complete elimination of tax policy uncertainty is estimated to have the following effects (relative to the size of the 2024 US economy):

- Increase US jobs by 2.9% (4.7 million jobs), on average, in each of the next 5 years and by 1.1% (1.8 million jobs) each year thereafter.

- Increase US capital expenditures by 1.9% ($71 billion), on average, in each of the next 5 years and 0.7% ($28 billion) each year thereafter.

- Increase US company revenue by 2.0% ($1.1 trillion), on average, in each of the next 5 years and 0.8% ($439 billion) thereafter.

- The increase in federal tax revenue associated with this increased economic activity is estimated to be more than $800 billion over the 10-year budget window (2025-2034).

The one thing standing in the way of all this good news is the fear that Trump’s Tax cuts will expire next year – as the Left has promised.