One of the best features of the 2017 Tax Cuts and Jobs Act (TCJA) was the doubling of the federal death tax exemption to $13.6 million. This is an evil tax that leads to the dissolution of family-owned businesses and discourages saving. But if the TCJA is allowed to expire at the end of next year, about two to three times more family farms and businesses will get hit by the tax. That’s bad enough, but something much worse could be coming.

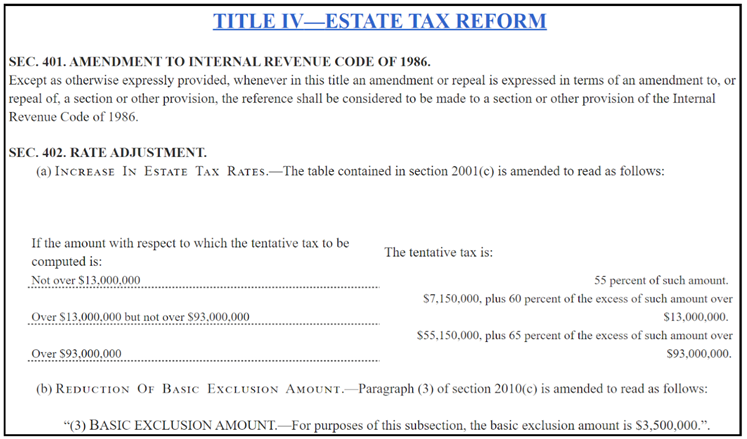

Elizabeth Warren has introduced a bill to spend about $500 billion on new housing subsidies, with a goal of building 3.2 million housing units and subsidizing first-time home buyers. The bill (the American Housing and Economic Mobility Act of 2024) includes slashing the estate tax exemption all the way down to $3.5 million, and raising the rates from a current flat 40% to rates ranging from 55% to 65%.

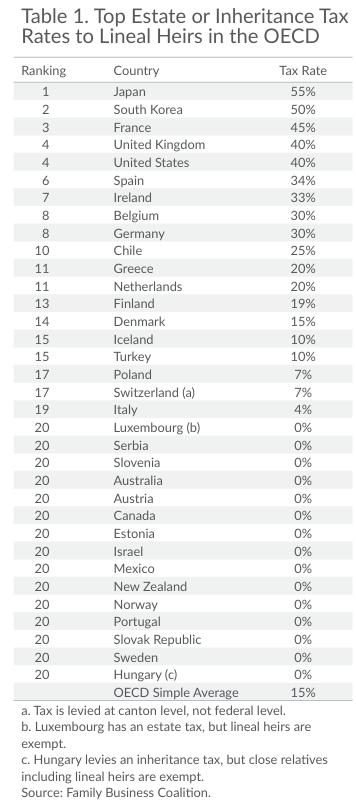

The chart below shows the U.S. already has one of the highest death taxes in the world and we would be the highest in the world under the Warren bill.

This policy would be an economic and moral catastrophe, but has been endorsed by Mark Zandi and may be a priority for progressives in the next Congress and administration.