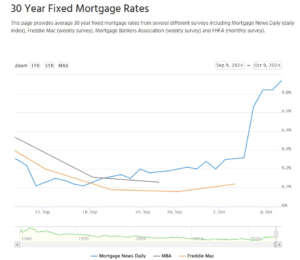

| Ever since investors started pricing in the Federal Reserve’s “jumbo” 50 basis point cut in the federal funds rate, most other interest rates have…RISEN.

That’s not supposed to happen. But you can see that so far, the market reaction to the Fed’s announcement three weeks ago has been the opposite of what was expected. The 10-Year Treasury was about 3.6% when the Fed cut, and is now above 4%. We see a similar upward movement with the Treasury’s 30-year bond. Why is this happening? One answer is that even though the CPI rate was down in September, inflation has risen sharply in the last two weeks (This rise was not reflected in the inflation number released this morning). The commodity index that we showed last week is now up 9% since the Fed rate cut. There’s a useful economic lesson here. The Fed doesn’t have some magical fairy dust it can sprinkle over the economy to make it grow faster. We know this revelation may be unsettling to some of our Wall Street friends who believe the opposite. Markets should and ultimately do determine interest rates – not the wizards at the Fed. The Fed should simply keep the dollar stable in value and inflation rates low. Leave the financial markets alone. |