Bernie Sanders is seizing on a throwaway line in a Trump speech to suggest legislation permanently capping credit card interest rates at 10 percent.

What Trump actually suggested was a temporary three-month reduced-interest holiday to help consumers dig out from under Bidenomics.

The banks might consider voluntarily adopting the holiday to help usher in a new era of good feelings. But a mandatory rate cap is a bad idea because, like all price controls, it will cause shortages and squeeze millions of poorer people with lower credit scores out of credit card access. They’ll be forced to turn to payday loans, loan sharks, or bounced checks in a crunch. Even when flush, they’ll have to carry large wads of cash around to pay bills.

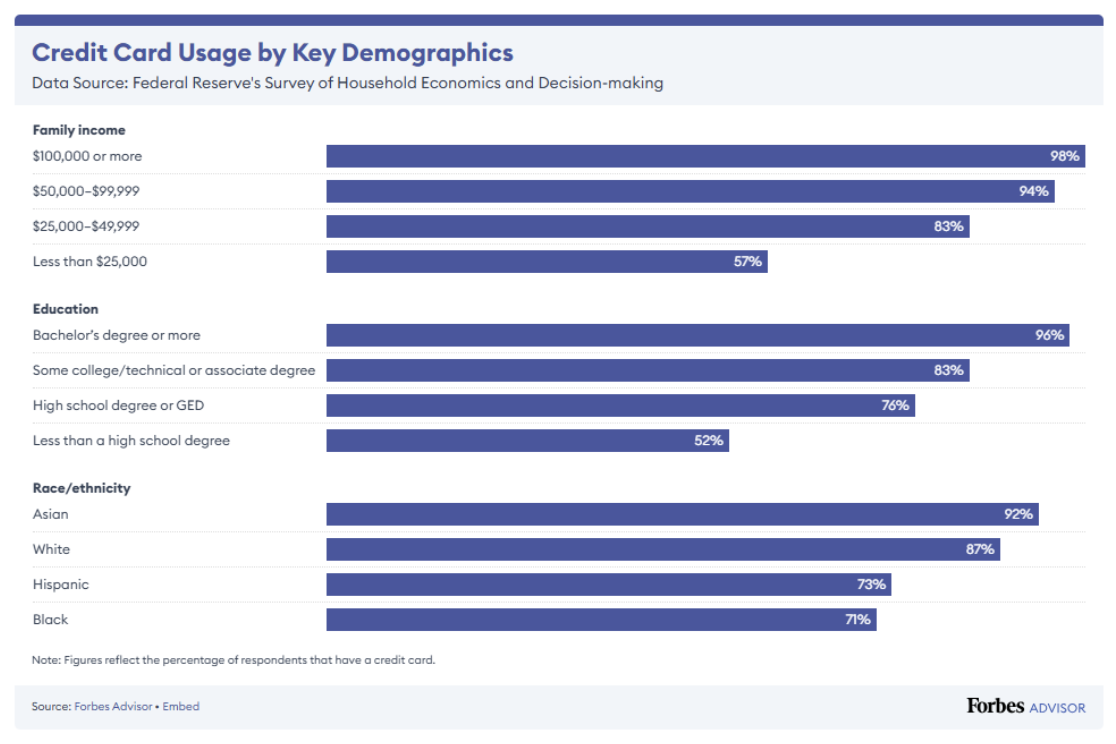

This data from Forbes shows that most Americans have credit cards today, but minorities and lower-income Americans have lower access. Price controls will inevitably hit them the hardest.

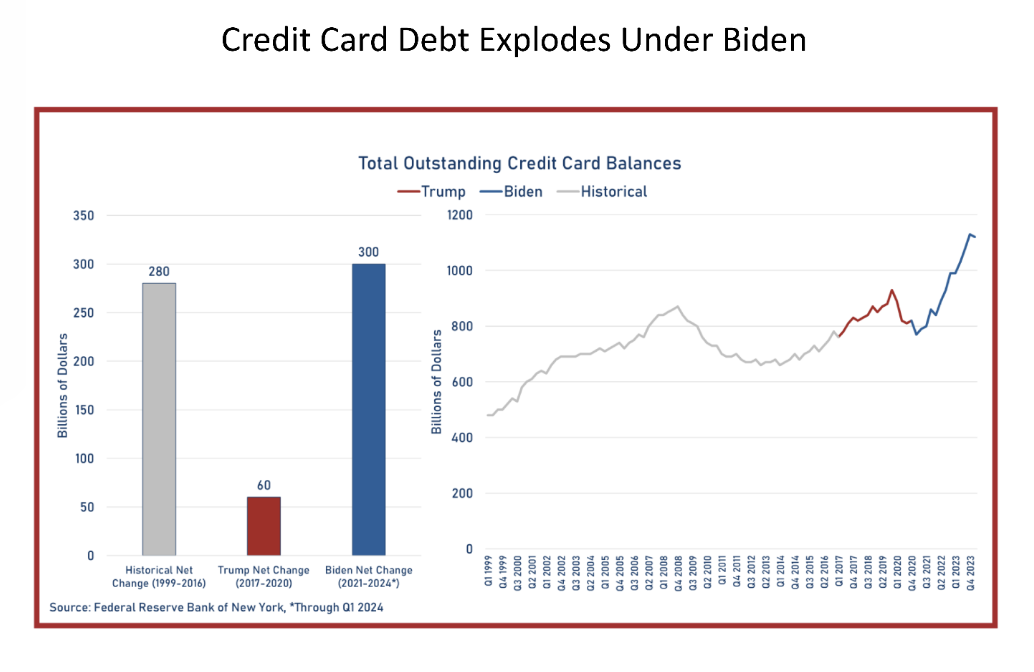

The solution to rising credit card debt is to get real wages rising again and stop the inflation that caused an explosion of credit card debt under Biden.

Our friend Joel Griffith from Heritage makes the case well in The Hill: