On Monday, we blew the whistle on the fiscally reckless scheme to plus-up Social Security benefits for retired government workers, who spent most of their career exempt from Social Security taxes, while they were covered by more lucrative pensions. It’s a $200 billion raid on an already actuarial bankrupt program.

Yesterday the WSJ joined the drumbeat with an editorial that explained exactly why the so-called Social Security Fairness Act is profoundly UN-fair:

Government workers who spend some of their career in private industry are entitled to Social Security benefits. However, the standard Social Security formula treats years employed in government as if workers have zero earnings. This reduces their average earnings in the equation and thus increases their wage replacement rate.

As a result of this formula quirk, government workers who spend some years with private employers would get a relatively larger benefit than similar-earning workers who spend their entire careers in private industry. Congress in 1983 sought to fix this injustice with the Windfall Elimination Provision (WEP), which reduced benefits for such government workers.

Now they want to give an extra bump in benefits to these public employees when they retire. How is that fair?

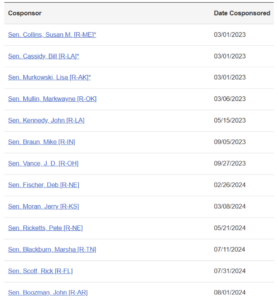

Now, the only thing that can stop the Schumer steal is a Senate filibuster. But the unions have convinced 13 Senate Republicans to co-sponsor it, enough to overcome a filibuster if no one drops their support. There are some surprising name so this list, which we include below for your easy reference:

Amazingly, the first big vote in Congress since the Trump election will be to inflate the debt by another $200 billion – and it very well may pass.