From the moment in 2016 when we started working with Donald Trump on tax policy, he has talked longingly of a 15% tax on domestic businesses. He still does. In 2017 he won a reduction in the rate down to 21% (federal) from 35%. That was a great pro-growth accomplishment, but we still have a rate that is above the level of many countries.

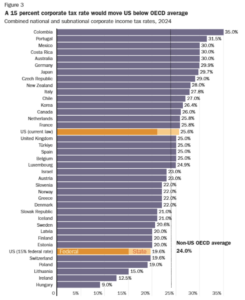

The chart below, from Cato’s Adam Michel and Joshua Loucks, makes a compelling case for Trump’s proposed 15% corporate rate.

The cut would take us from the middle of the pack to one of the lowest rates among OECD countries:

Also, remember that the corporate tax is a double tax because we also tax corporate earnings via the dividend and the capital gains tax. To view the entire analysis, click here to visit Adam Michel’s Substack.