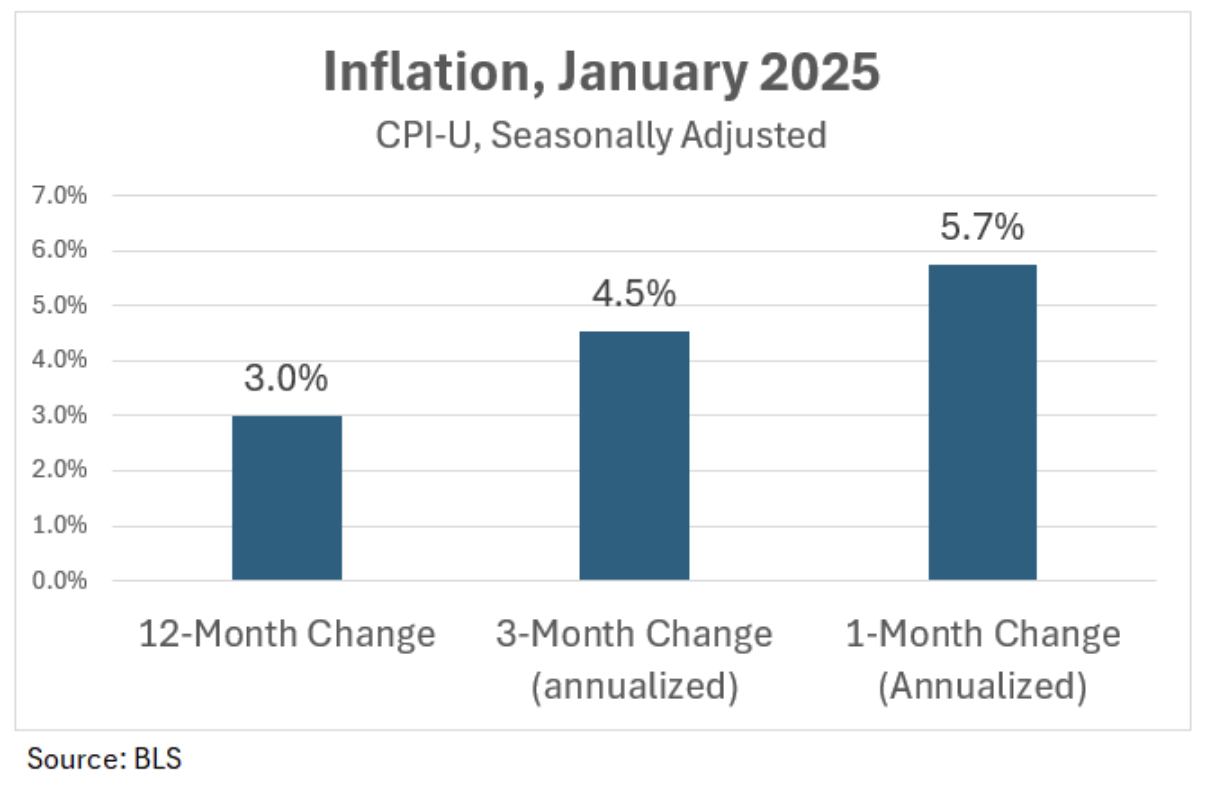

We hate to say we told you so, but yesterday’s inflation report was worse than the common headline that the rate nudged up to 3%. The media buried the lede. The headline should have been that for the month, prices were up on an annualized basis by closer to 6%.

For the past three months, on the heels of the last Fed rate cut, it’s up 4.5%. So much for the Biden narrative that he left Trump a strong economy, when the government is on a path to another $2 trillion overspending deficit.

That’s a long way from the Fed’s 2% target.

We saw this coming from a mile away by monitoring the CRB commodities index. Here it is again, over the past six months.

Trump and investors want another Fed rate cut, but we are highly skeptical. How can the Fed pump more money into the economy when inflation is running double its target?

Trump’s growth agenda is over the long term deflationary not inflationary. But nothing could more abruptly end the magic carpet ride he’s on right now with voters, than rising prices.

Cut taxes and spending as quickly as possible.