In one of our first meetings with Donald Trump in early 2016, he wisely observed that America’s highest in the world corporate tax rate was “like a tariff that we impose on ourselves.”

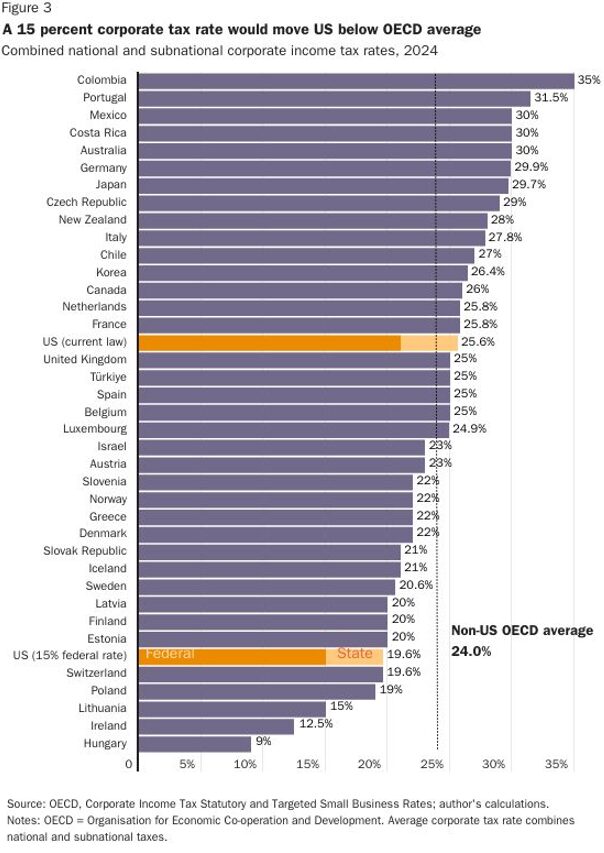

His 2017 Trump tax cut reduced the U.S. business tax rate from the highest to the middle of the pack. See chart.

Trump is now pushing a 15% corporate rate for companies that make products in America. This is a good way to reduce “the tariff we put on ourselves.” Instead of taxing other countries’ goods more, we win by taxing our own goods less.

A Cato Institute study in early 2025 found that the Trump plan “would give America a lower corporate income tax rate than all but 5 OECD countries, put the US in the bottom third of all countries in the world, and undercut China’s 25 percent rate (China is a non-OECD member).”