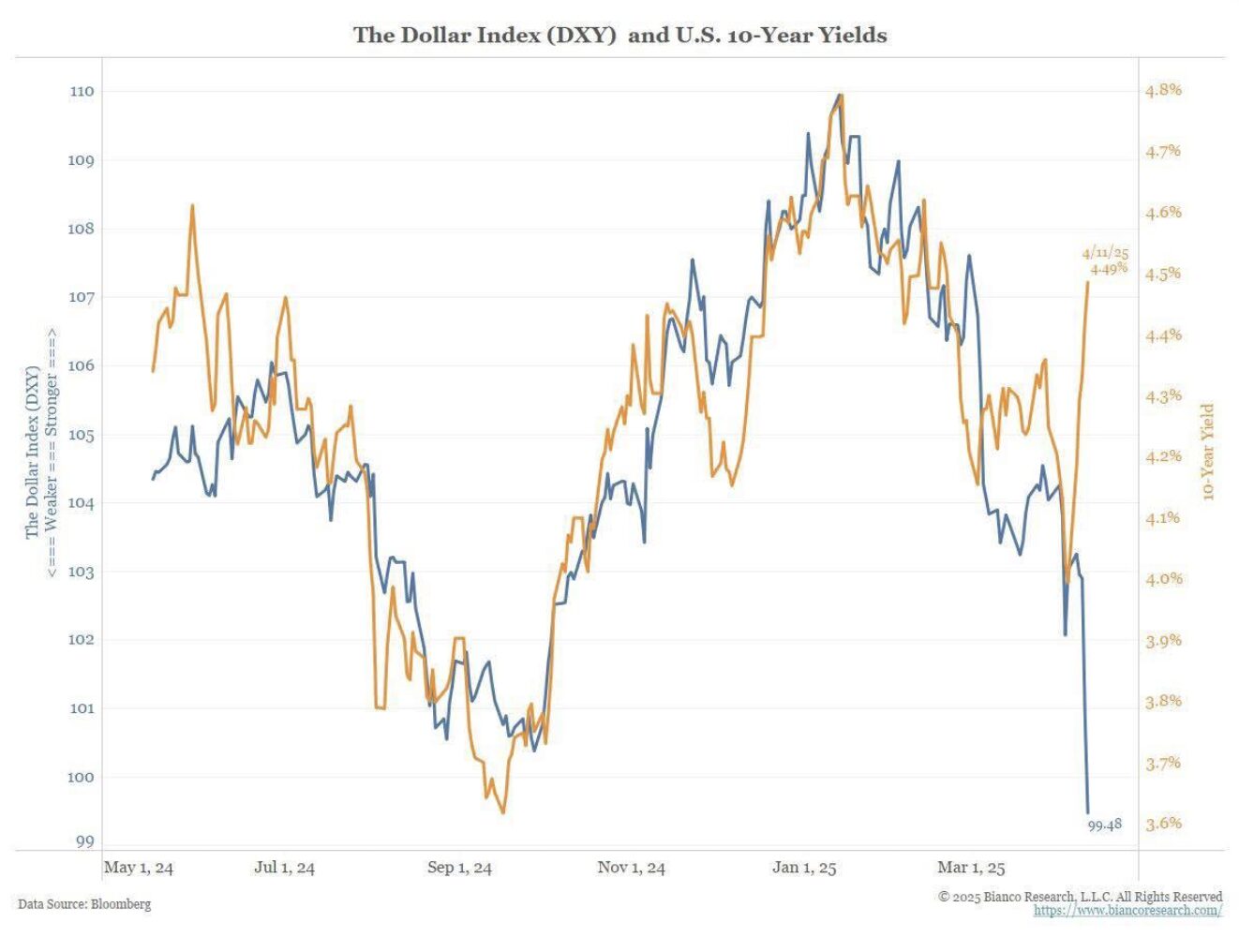

The chart below, sent to us by economist Mark Skousen of Chapman University, shows that over the past several weeks, we have seen a coincident rise in the interest rate on the 10-year Treasury and a decline in the value of the dollar against gold and other currencies.

These are both BAD financial signs. The 10-year Treasury interest rate has fallen slightly in recent days, but is at 4.5% and up about 80 basis points from six month ago. This could be linked to a threat of higher inflation and a loss of confidence in the American economy. In addition, the hike in rates make the budget deficit worse because the U.S. government has to borrow at higher interest costs.

The 5% fall in the value of the dollar is also problematic. The dollar decline means that at the margin, investors are starting to bet against America as the world’s financial safe haven.

The politicians seem to have forgotten that American workers get paid in dollars, so a fall in the dollar’s value is like a hidden tax on worker paychecks. It also contributes to higher import prices – thus contributing to inflation.

Some economic voices in the White House favor a weaker dollar as a way to bring down the meaningless trade deficit. No, it’s a way to make America poorer. Don’t go there Mr. President.