Yesterday the gold price broke the $3,500 high water mark for the first time, and then when trade deals were announced, the price fell back to $3,350.

But since the start of the year the price is up more than 30%. Show us an asset class that has produced those kinds of returns.

This higher gold price is a very bad sign. It means money is migrating out of productive private investment into the safe-haven holding pattern of gold. We think that this is a partial hedge against inflation, but more a fear of continued economic/tariff turmoil.

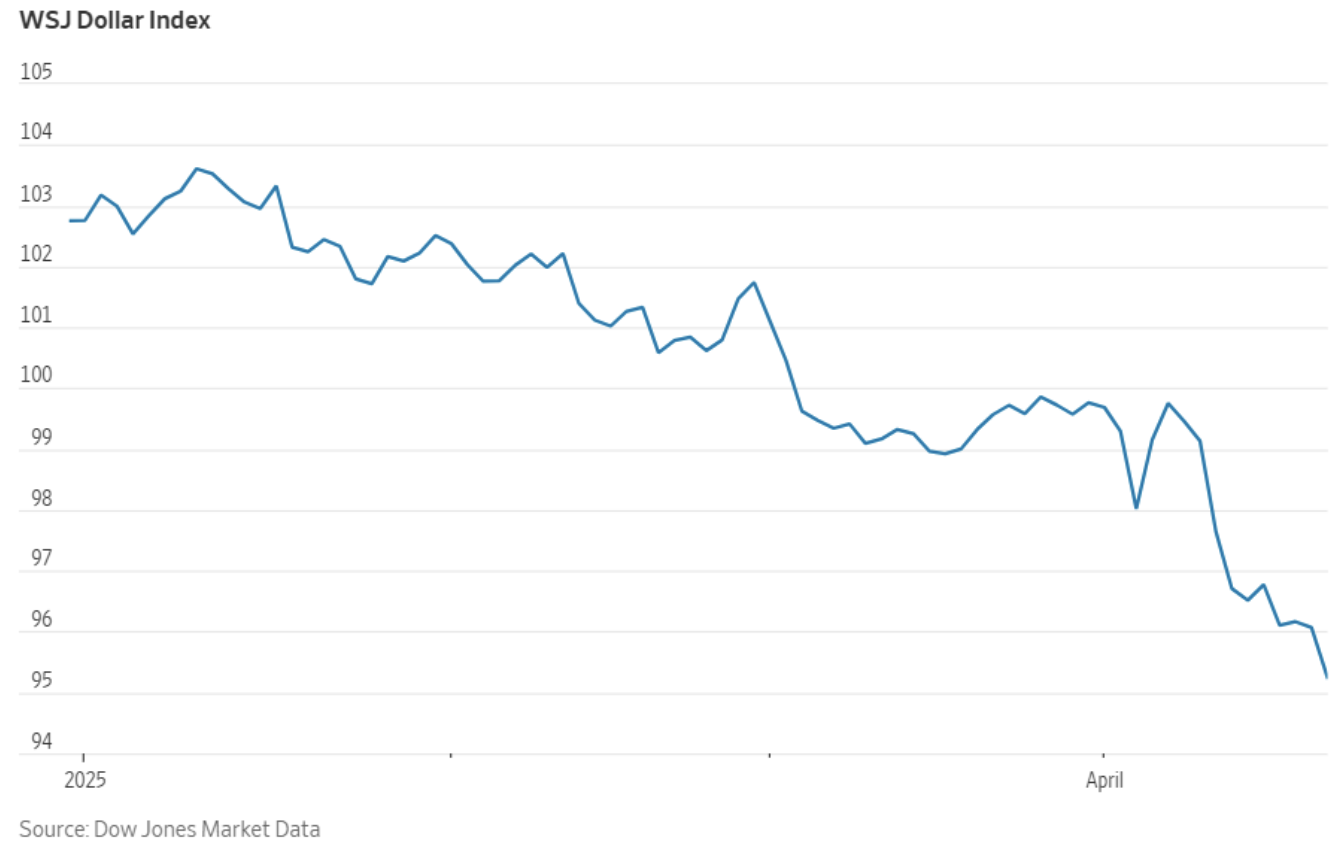

We are also seeing the gold price rise inversely with the fall in the dollar.

These are the bitter fruits of Navarro-nomics so far.

If President Trump insists on tariffs, he should call for a 15% across the board import tariff to be offset with slashing federal tax rates to 15% on everything else. The market would snap back pronto and red ink would be turned green.