Not one Democrat in the House or Senate will vote for the Trump tax bill, yet the Republicans in Congress insist on retaining and even expanding the state and local tax SALT deduction for companies and individuals, even though 75% of the benefits go to blue states!

In other words, SALT isn’t just awful economic policy – because it rewards higher property and income taxes in state capitals and cities – but it’s politically dumb as a a stone.

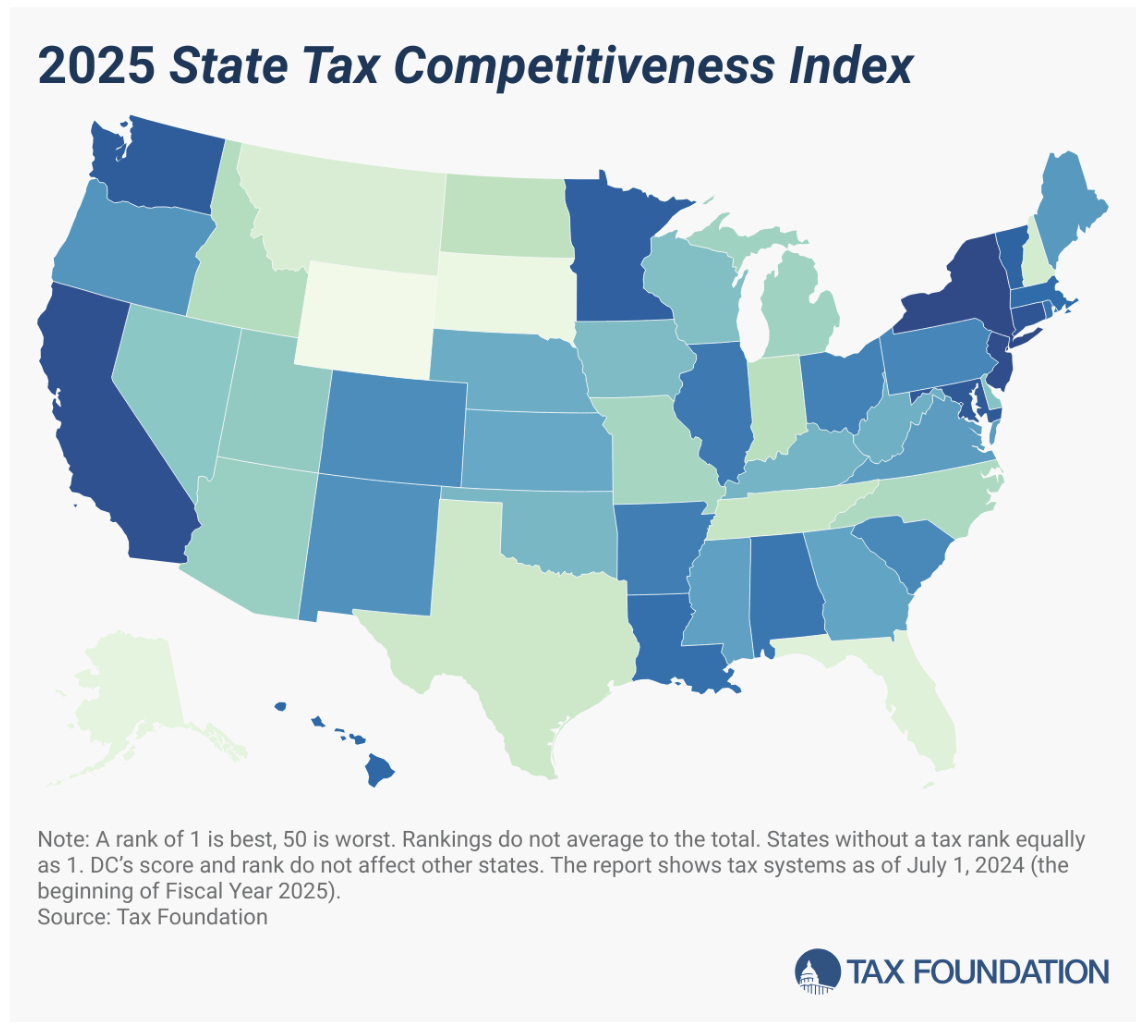

The list below shows the 10 states with the highest business taxes and the worst climate for business in 2024. Every one of them is a deep blue state run by a liberal governor:

The way to pay for the Trump 15% corporate tax rate is to put a cap on the corporate state and local tax deduction based on a percentage of their adjusted gross income.

This would incentivize businesses to move headquarters and operations out of blue states into lower tax red states. It would also force states like New Jersey and New York to lower their taxes to the benefit of their own residents.

It would not raise the effective tax rate on American corporations because the tax rate on their profits would fall from 21% to 15%.