Time for our latest report on prices.

Everyone – including us – warned that the Trump tariffs could reignite inflation. The jury is still out, but so far, at least, consumer and producer price rises have been tame. Our favorite forward-looking indicators of inflation still surprisingly show prices rising at around 2.5% to 3%. This is above the 2% target, but not a major problem – at the moment.

* Commodities – The CRB index of major commodities from corn to copper to coal, show prices almost exactly where they were when Trump took office. The prices have tended to rise and fall based on the latest news on tariffs with market liking peace on the trade front.

* Gold – gold is a hedge against inflation and a rush to safety in times of economic turmoil. A rising gold price is always a bad sign. The gold price since the start of the year has surged by 26%. That’s very worrisome, but after a spurt at the start of the year, over the past month, the gold price has stabilized.

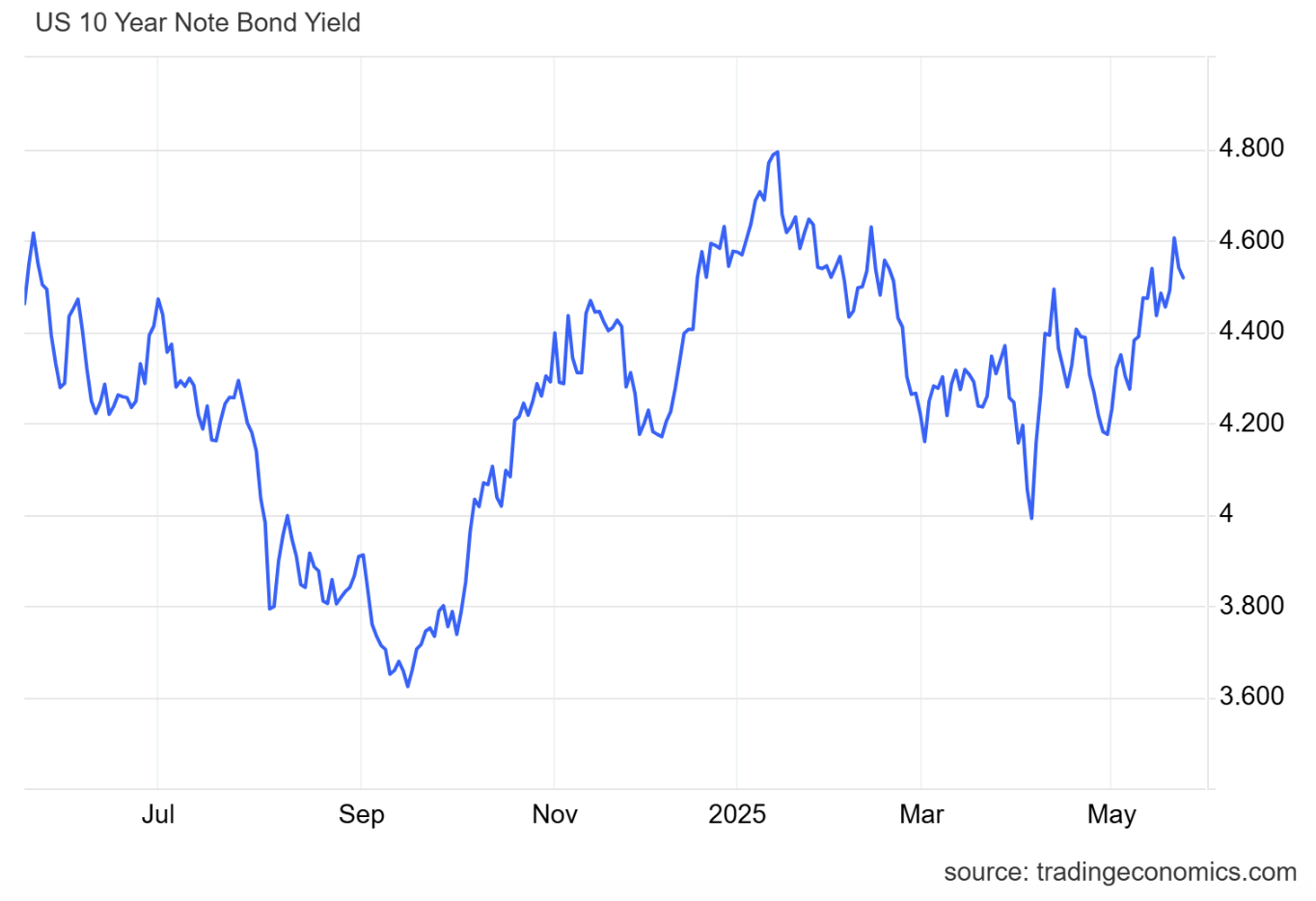

* Ten Year Treasury – Since the start of the year the 10-Year Treasury interest rate has been flat but with wild fluctuations. The rate rose at the start of the tariff threats but has leveled off in recent weeks.

* Tips Spread – The Tips spread is the difference between yields of nominal and inflation-protected bonds. It measures how much inflation market participants expect to see over a certain period, based on the prices of these bonds. Since the beginning of the year, there has been about a one percent increase in the tips yield.

All of these charts tell pretty much the same story. The markets hate tariffs, but have become more confident of stabilized prices over the recent weeks as Trump lines up tariff deals with major trading partners and as the prospects for the big beautiful tax bill continue to improve.