The latest Social Security Trustees Report indicates the program becomes technically insolvent in 2033. The only solution the politicians can come up with is shafting young people, by making them pay more into the system and offering them lower benefits when they retire.

In other words, they want to make a bad deal for our kids even worse. What a solution!

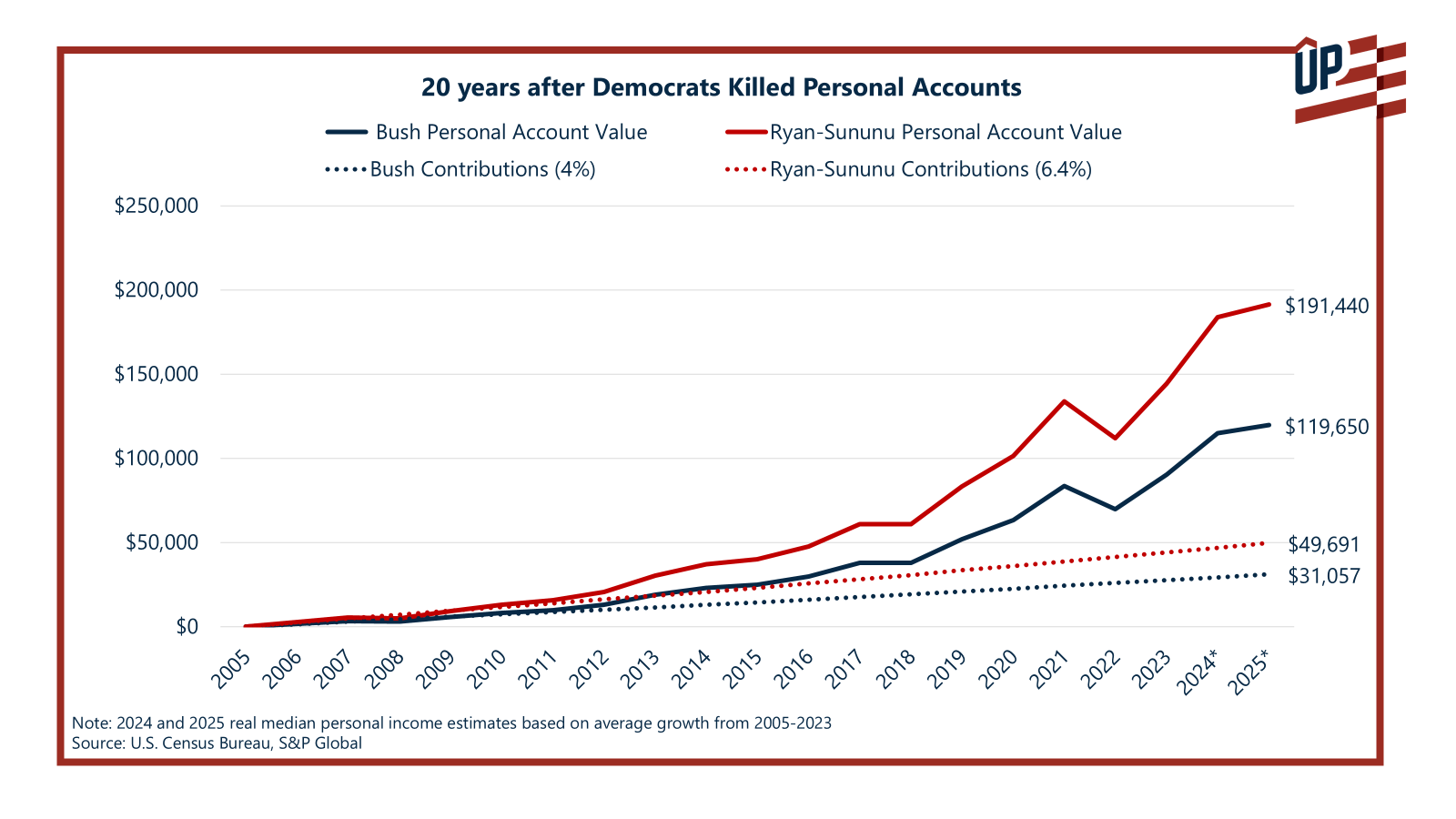

We’ve pushed for transitioning to 401k-style personal accounts for Social Security for several decades. So we wondered how much money would be in personal accounts now if they had been enacted 20 years ago, as President George W. Bush endorsed.

Liberal opponents claimed the accounts would be “too risky” and they killed the reforms.

We put together a simple estimate for each proposed contribution starting during the 2005 Social Security debate (4% for Bush and 6.4% for Ryan-Sununu), based on real median personal income and the annual returns of the S&P 500 over the last 20 years. The average worker would today have a nest egg of almost $200,000 if we had allowed half the payroll taxes to be put into these accounts. Over 40 years, these accounts would hold well over $1 million.

Amazingly, as far as we can tell, not one of the liberals who opposed the idea has apologized for robbing our workers of hundreds of thousands of dollars of wealth.

Worse, they are STILL spreading these lies that personal accounts are “risky.”