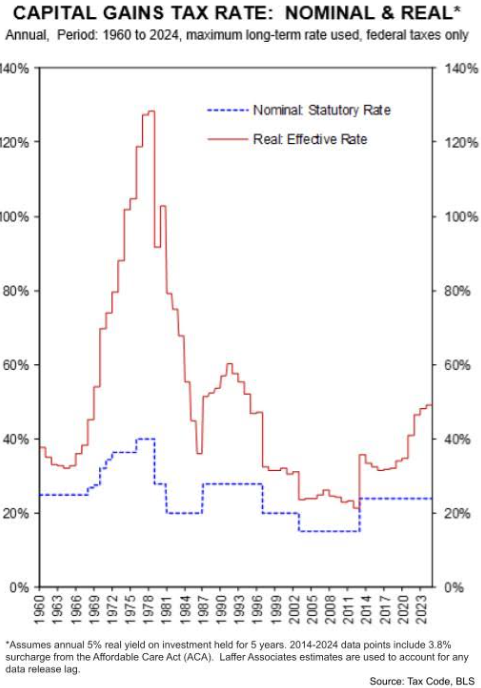

If you bought a stock at the start of the Biden presidency for $10,000 and sold it off four years later at a price of $12,200, you would pay a tax on “the gain” of $2,200. But over that time period everything rose on average by 22% thanks to Bidenflation, so you didn’t really gain anything.

This is an unfair tax on phantom gains that penalizes investment. It hurts seniors the most because the longer they hold an asset, the more the inflation penalty accumulates. The statutory 23.8% capital gains tax rate can rise to 50% or even above 100% if inflation gets into double digits, as in the 1970s.

This is why we at Unleash Prosperity have been urging the White House to end this unjust inflation tax.

Trump could do this by ordering the Treasury Department to properly define a “capital gain.” as any increase in the value of a stock or property AFTER INFLATION ADJUSTING from the time of the purchase of the asset to the time of the sale. Trump would get a hero’s welcome for doing it. We could score another important tax victory in the war against anti-growth taxation.