Our latest 2025 study on Pension Politics will be released next week and…good news: we find that big money managers are retreating from ESG and DEI social investing in a hurry. We’ve argued for the past three years that ESG investing is a violation of the fiduciary duty of investment firms to earn the maximum returns for their clients.

ESG investing is at best a distraction from the pursuit of high returns.

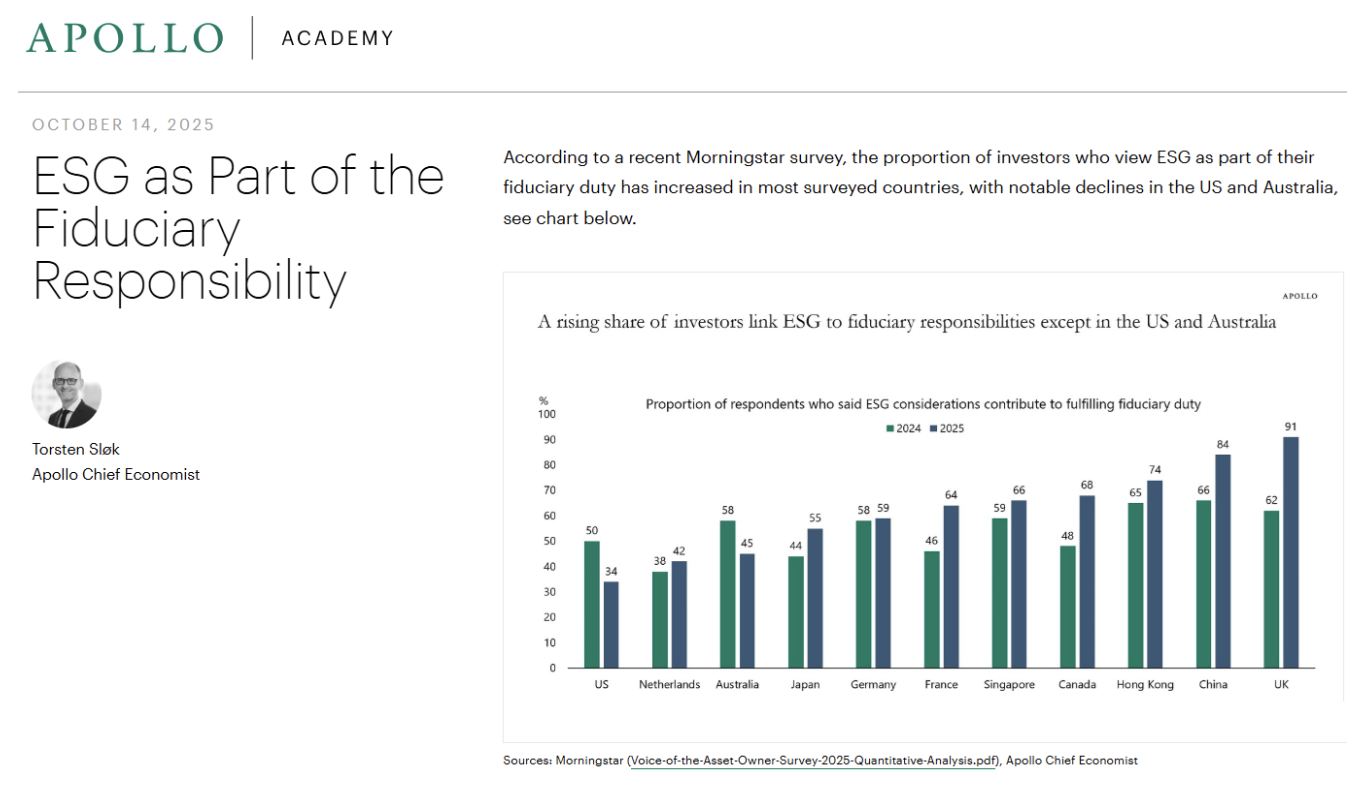

So our jaws dropped when we saw that Apollo is touting a new Morningstar report which purportedly concludes that investors STILL want ESG and view it as part of the fiduciary duty.

It’s complete nonsense.

What investors tell pollsters that they want, versus how they ACTUALLY invest, are two entirely different animals. We know this because money flows relentlessly into the highest return investments and flows out of low return investments. Period. Hard stop.

We’ve often noted that if investors want to be “socially conscious” and pack their money into firms that are openly ESG – have at it. Those funds are out there. And what we know about these funds is that a) they generally underperform the market and b) they are undersubscribed.