We got plenty of pushback from readers (especially the gold bugs) on our item last week, noting that returns on stocks had done multiple times better than returns on gold since 1980.

Several astute readers noted that our starting point of 1980 was timed exactly when gold had peaked after the disastrous monetary and fiscal policies of the 1970s. Fair point.

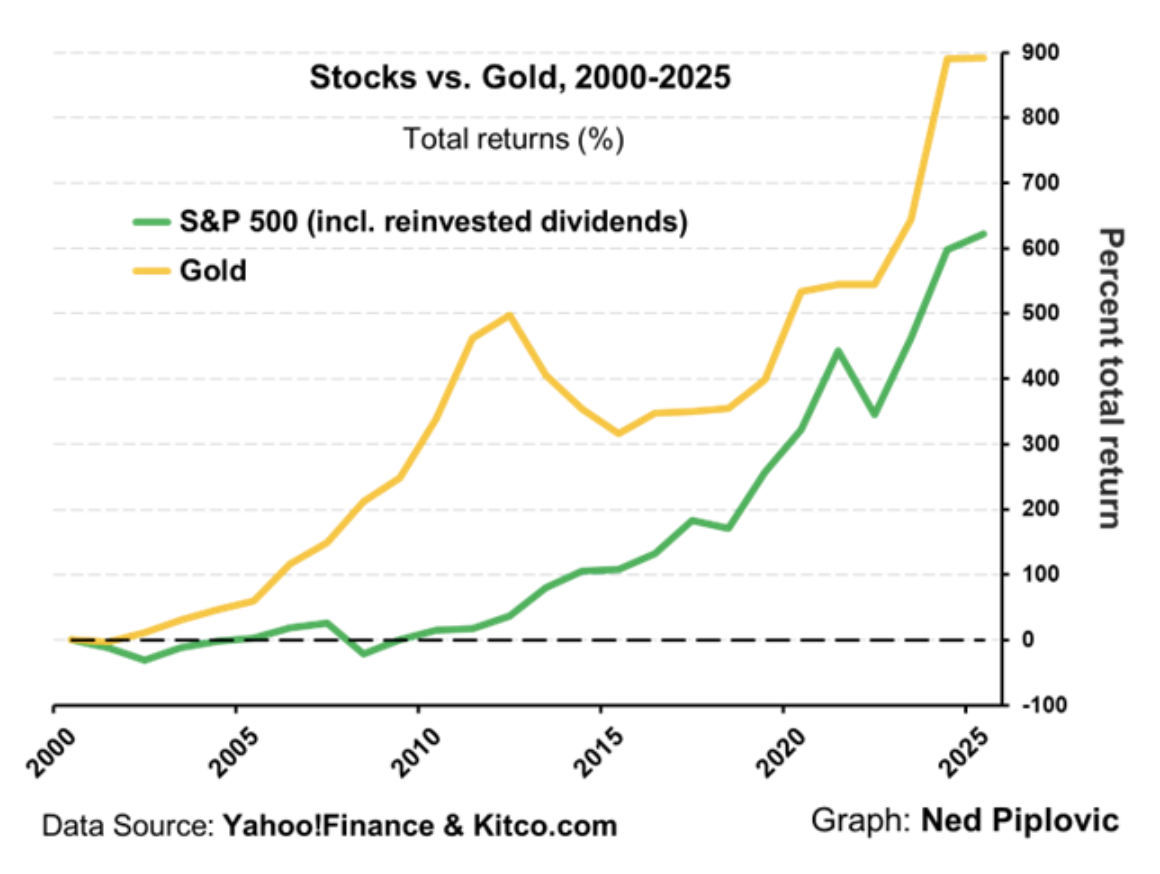

Other readers pointed out that so far in the 21st century, gold has outperformed stocks.

Let us put a fine point on the argument that we were TRYING to make. It’s a very simple one.

Bars of gold have little intrinsic value in this day and age. Gold is simply a store of value, which is what money ($$$) is supposed to be. When economic policies run amok and central bankers allow inflation to rear its ugly head, investors run for the exits and buy gold as a security blanket. When economic policies are pro-growth and the dollar is strong and stable, gold is redundant. Gold prices only rise when there is economic turmoil and inflation.

The reason we picked 1980 as our starting point is that Reagan’s policies were a pro-growth/strong dollar economic inflection point. Lower tax rates, deregulation, peace through strength, and a Fed chief in Paul Volcker who was an inflation hawk par excellence caused gold to tank.

It is true that since 2000, gold has outperformed stocks, but much of that rise was due to the runaway spending policies under Obama and Biden. Gold prices have also risen under Trump 2.0 especially when the tariffs were announced. If you believe, as we do, that on balance Trump’s pro-business economic orientation will create another investment boom in the U.S., then gold prices are likely to stabilize and perhaps even fall.