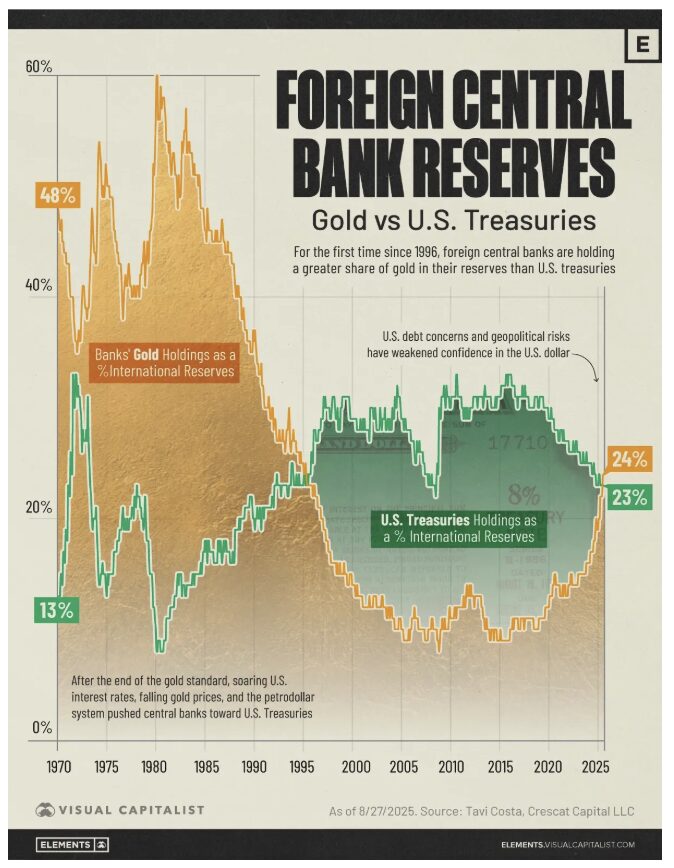

The Visual Capitalist website may offer some insight into two mysterious and troubling trends: first, the 60% rise in the gold price over the last year – even as inflation has moderated; and second, the fall in the dollar. The chart shows that since around 2020, foreign central banks (mostly the Chinese) have been selling U.S. government bonds and transferring that money into purchases of gold.

For the first time since 1995, these central banks hold more gold than U.S. Treasuries.

Larry Kudlow has said he suspects this is an aggressive and orchestrated attack on the dollar by President Xi in Beijing.

He may be right, but China may be crazy. Beijing’s futile attempt to replace the dollar as the world reserve currency will fail miserably. In times of global crisis and turmoil, investors buy MORE, not fewer, dollars as a flight to safety. Anyone who would rush off to invest in BRICs (Brazil, Russia, India, and China) as a more stable alternative is likely to suffer large losses over time.