We were assured that if Mamdani won the mayor’s race, don’t worry, he wouldn’t have the power to raise income and corporate taxes. Governor Hochul would never let a bone-crushing tax increase on New York businesses happen.

Oops!

This just in from Reuters, one week after the election:

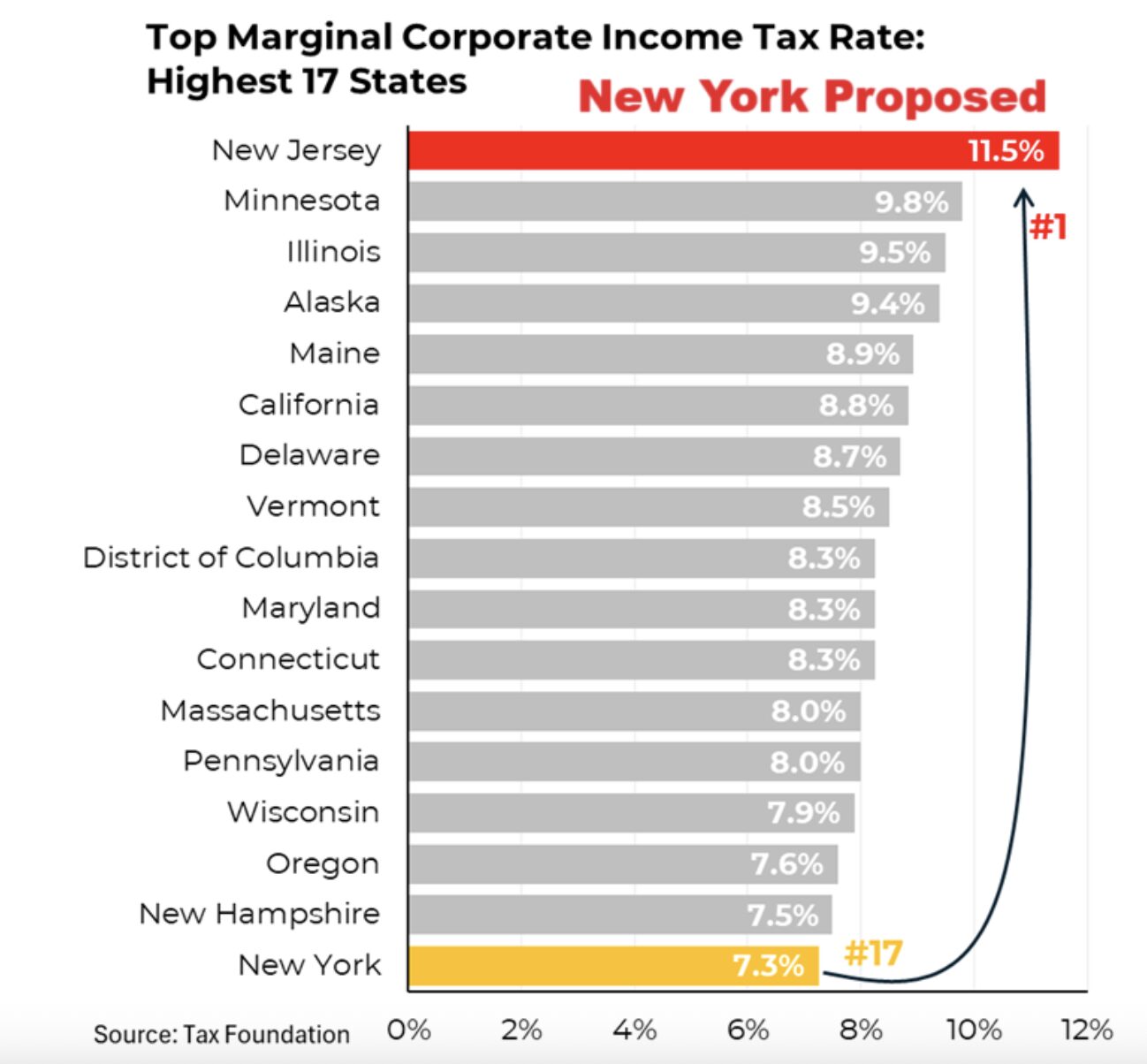

If Hochul implements the Mamdani tax plan, the state corporate tax rate would rise from 7.25 to 11.5%. This is on top of New York CITY’s corporate tax of up to 9% on financial corporations and 8.85% on non-financial businesses.

Throughout the Mamdani campaign for Mayor, Hochul had pledged not to raise business taxes. Now, she’s open to it. Turns out that promise was made during the campaign and appears to be well on the way to being rescinded. We know you’re shocked.

If this plan goes forward, New York State would move from the #17 highest corporate tax rate in the country to #1, tied with New Jersey.

But businesses in New York don’t just pay the state corporate tax. As EJ McMahon points out, they already pay the highest combined taxes in the country, even before the proposed hike, which would take the NYC combined rate to north of 20%:

Did we mention that New York City also has the highest state plus local personal income tax rate too?