Colorado is becoming bluer every day, so it’s no surprise that the agenda is tax and spend.

What a shame. A Democratic governor and GOP legislature approved a flat-rate income tax in the 1980s and in the 1990s voters passed TABOR, the toughest limit on spending of any state.

But the California invasion has allowed progressives to control all the levers of power in the Colorado legislature. They’ve watered down TABOR and are now gunning to replace the state’s successful flat tax (now at 4.4%).

The Democrats have placed a measure on next year’s ballot to impose a progressive tax with a dozen (!) brackets and would raise taxes by over $4 billion. As bait, those with lower incomes would see a small tax cut, while the wealthier would pay hundreds of thousands more a year.

We can’t think of a better way to make Colorado poorer.

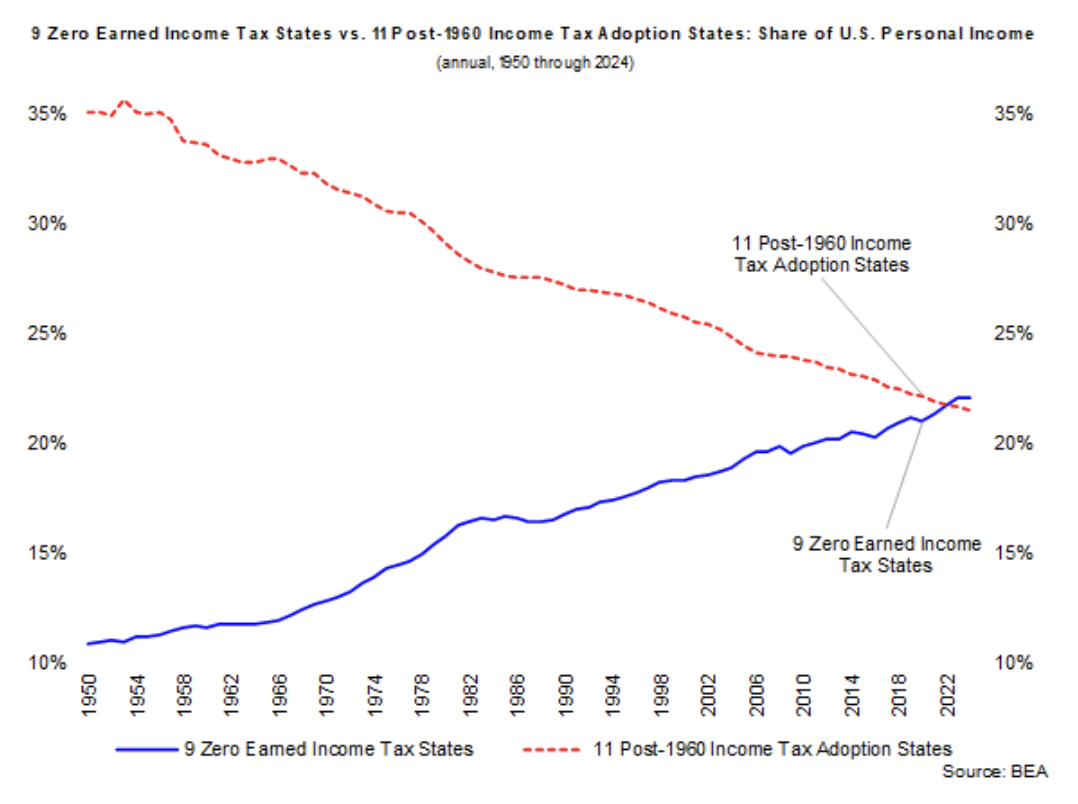

Our co-founder, Dr. Arthur Laffer, has shown that every one of the 11 states – including New Jersey, Illinois and Connecticut – that has adopted an income tax over the past 50 years has lost ground economically and population to non-income tax states.

Here’s our advice to Colorado voters: don’t turn your state into California!