From The WSJ, Sean Feiler and Jeff Bell advocate gold as the only credible means to discipline the Federal Reserve.

At Forbes, Louis Woodhill counters John Mauldin’s deleveraging mania with a call for higher growth.

On The Kudlow Report, David Goldman discusses gold and silver prices:

In The WSJ, Holman Jenkins, Jr. suggests governments will cope with debt through austerity and inflation.

At Future of Capitalism, Ira Stoll wishes the Ryan tax plan made deeper cuts to corporate and individual tax rates.

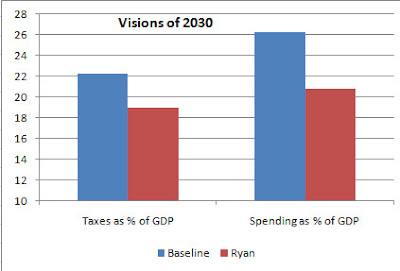

On COAL, Paul Krugman argues a significant portion of the Ryan budget plan cuts spending on seniors and the poor to fund lower tax rates on corporations and top earners:

From The Hoover Institution, Kip Hagopian notes the inequities of the progressive tax system.

On TGSN, Ralph Benko reports a good article on the gold standard from the Economic History Association.

At National Review, Ramesh Ponnuru argues the Fed was right to enact QE2.

The NYT reports progress on the Colombia trade agreement.