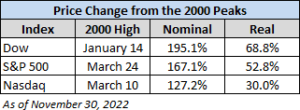

Take a look at the nominal and the real (inflation-adjusted) of the S&P 500, Dow 30, and Nasdaq Composite since 2000. We’ve updated this through the November 30, 2022 close.

The nominal returns have been high, but when accounting for inflation/purchasing power, the returns have been mediocre at best. On average the stocks have yielded roughly a 50% real return, but on an annualized basis that’s less than 2% over 22 years. (This chart doesn’t account for dividends, so the returns with dividend reinvestment are higher.)

This compares with a historical rate of real return on stocks above 6%.

But even with these historically lower-than-average returns, if workers had been permitted to simply invest their social security taxes in a private 401k savings account, a 65-year-old retiring today would receive more than twice the monthly benefit that Social Security promises to pay. Social Security is robbing Americans of their wealth and private markets ALWAYS outperform government.