The Biden administration has proposed a tax on unrealized capital gains and some prominent Democrats want to raise the death tax to 65%.

How well do these wealth taxes work?

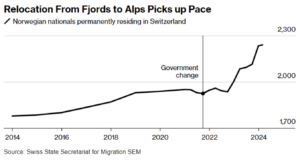

A cautionary tale comes from Norway, which in 2022 increased its annual wealth tax from 0.85 to 1.1%, and upped its dividend tax to 37%. Here is what happened:

Eighty-two rich Norwegians with a combined net wealth of about 46 billion kroner ($4.3 billion) left the country in 2022-2023, with 34 moving out last year alone, according to data from the Finance Ministry. More than 70 of those have moved to Switzerland, business daily Dagens Naeringsliv reported in January.

Keep in mind, Norway only has less than six million residents. So this would be the equivalent of more than 2,000 Super Rich leaving the U.S. The destination of choice is Switzerland, where the wealth tax is 90% lower.

Notice the big bump in leavers after the tax hike:

We love the indignation of the Norwegian politicians who sneer that these exiles are breaking the “social contract” by fleeing. Wrong. Expropriating people’s wealth is the real violation of the social contract. Hopefully, U.S. pols will understand that.