Could the American Debt time bomb crash the U.S. economy? Judge for yourself:

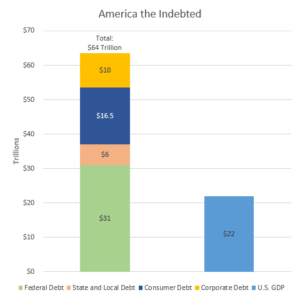

The King Kong of borrowing is Uncle Sam. The national debt is now $32 trillion when including the unfunded liabilities of social security and Medicare. That’s getting close to 150% of our national GDP of $22 trillion. Some $5 trillion has been added in just the past three years. Balancing the budget seems like a pipe dream these days.

Add to that state and local government debt and unfunded liabilities, which ALEC estimates at just under $6 trillion.

Consumer debt reached $16.5 trillion last month – up 16% over last year according to the New York Federal Reserve. Most of that debt is mortgages at $14 trillion, but, as we noted last week, increasingly Americans are taking on debt to pay for routine expenses to pay monthly bills like groceries and gas at the pump. Thanks, Joe Biden.

Add to that corporate debt and the grand total is $66,000,000,000,000 of red ink -triple our annual GDP.

Debt isn’t necessarily a bad thing. When we borrow for roads or factories or homes or to finance our military to win wars, or pro-growth tax cuts, borrowing can be necessary and appropriate.

But we aren’t doing that today. We are borrowing to pay people not to work. We are borrowing to finance windmills and Teslas and “reparation” payments to other nations, and pouring money into failing schools, and Obamacare subsidies that go to Americans making up to $500,000.

We are acting like a nation of wild-eyed teenage girls on a shopping spree at the mall – armed with daddy’s credit card. This story may not have a happy ending.