There’s a lot of hand-wringing about how to “pay for” extending the Trump tax cut while adding in no tax on tips, no tax on Social Security benefits, and the 15% corporate tax rate. We’ve already suggested taxing university endowments with over $1 billion – which is a no-brainer.

Another obvious solution would be to close the state and local bond loophole. The Senate Finance Committee estimates ending this deduction would raise about $250 billion over the next 10 years.

The only people who benefit from the current deduction are Wall Street bond traders (who love debt), mayors, and public employee unions. But why would the feds, who are hopelessly in debt, borrow even more to encourage other levels of government to go into deeper debt?

It’s analogous to giving a drunkard another shot of whiskey.

Much of the borrowing for public infrastructure projects could easily be built and financed privately and paid for with user fees instead of property taxes. Privatization typically saves about one-third of the cost of public works projects. Just ask Donald Trump, who rebuilt Central Park’s Wollman Ice Rink at half the cost and in half the time of what the city had been unable to successfully do.

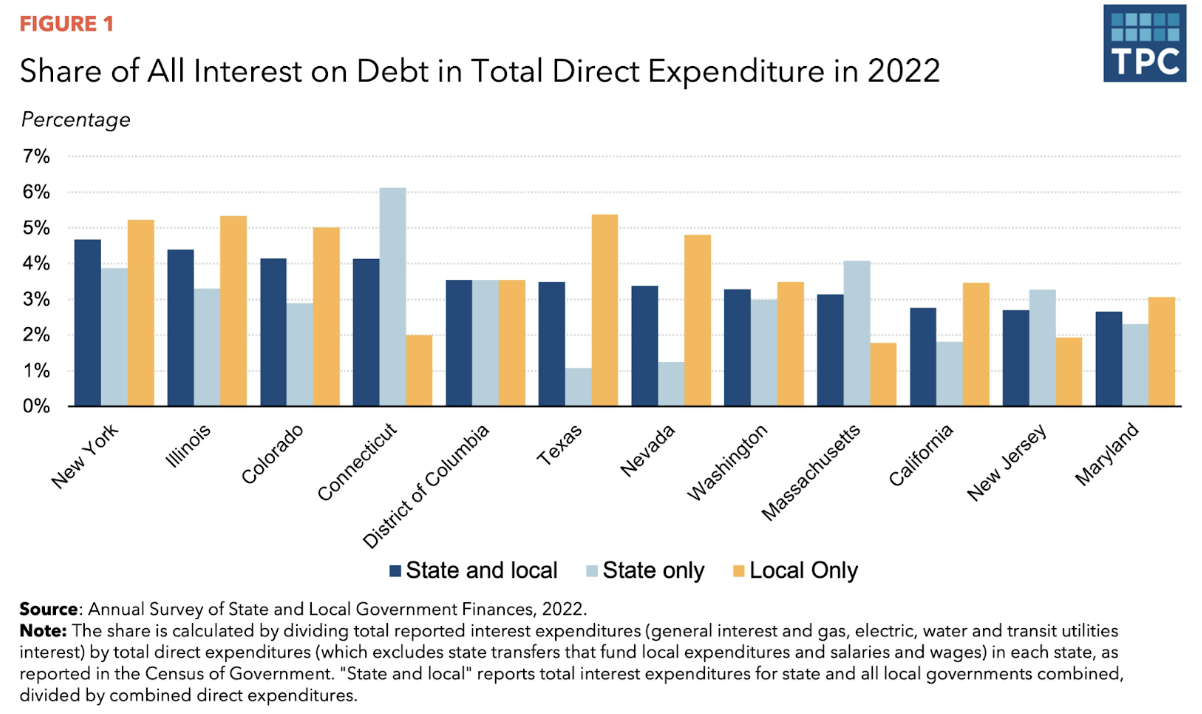

As the chart below shows, the biggest issuers of municipality bonds are flabby, high-tax blue states. It makes no sense that a Congress controlled by conservatives would subsidize borrowing by New York, Connecticut, and Illinois.