The Big Beautiful bill would keep U.S. tax rates on businesses and investment as low as possible to keep America globally competitive. That includes the 21% corporate rate and the lowering of the personal income tax rates across the board.

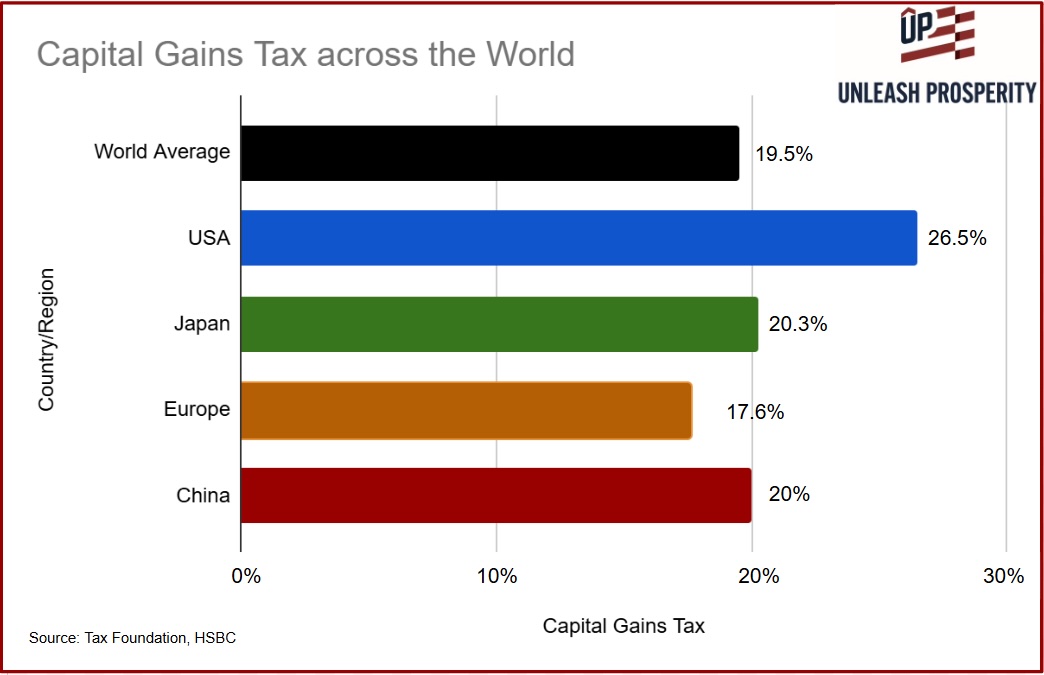

But the capital gains rate remains too high at 23.8%, with states adding another roughly 3 points. That’s higher than most of our key competitors. See chart. Lowering the cap gains rate to 15% and indexing taxable gains for inflation in exchange for ending the step-up basis at death would cause an unlocking effect and immediately RAISE revenue for the government, while reallocating trillions of dollars of investment to their best and highest returns.