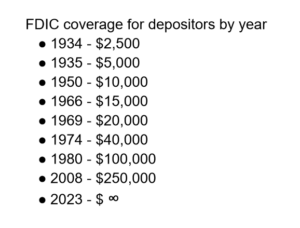

In the wake of the failure of the Silicon Valley Bank, the feds will now insure all “non-insured” deposits in banks. The financial markets seem to like this bailout, but the moral hazard problem here – as with all government bailouts – is immense. Bailouts only reward bad management and the dumb and often very risky investment strategies that caused the crisis in the first place. Here is a history of FDIC coverage of bank deposits (not adjusted for inflation), which were once supposed to protect the little guy investors, but now insure EVERYONE, even millionaires and billionaires. And, yes, the bailout amount is headed to infinity.