There’s a lot of chatter about a potential recession next year because of the so-called “affordability crisis,” facing families.

We’re not buying this pessimism. One of many reasons to be bullish is that most families haven’t felt the savings yet from the tax cut that passed in July.

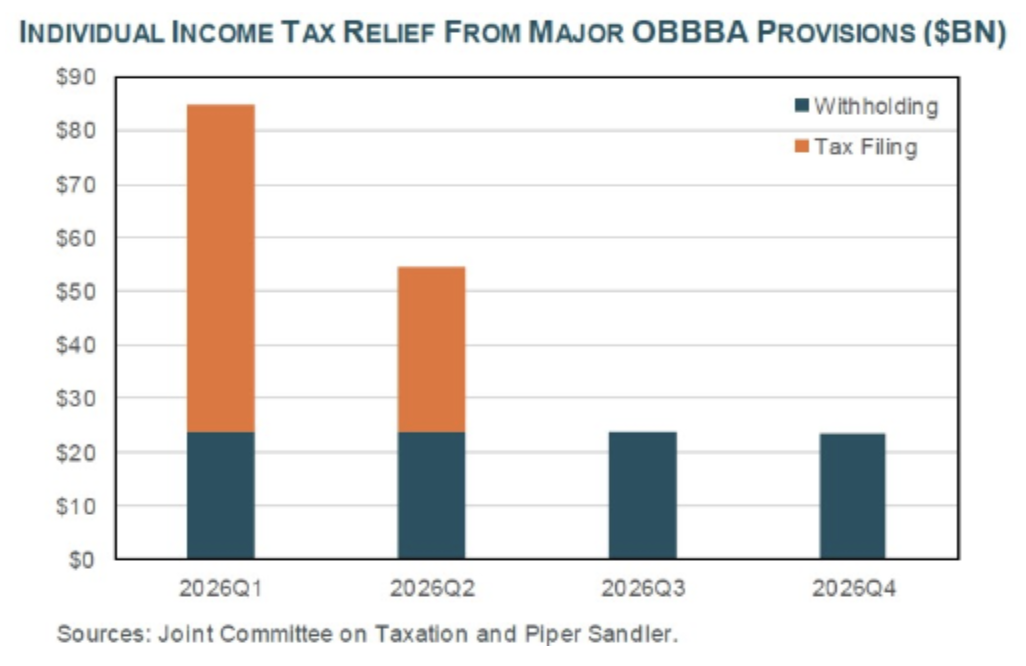

An estimated $190 billion of income tax relief (or about 0.5% of GDP) from the Trump Big Beautiful tax cut arrives in 2026, with most in the first half of the year:

The analysts at Piper Sandler notes that “it seems unlikely many people will adjust their withholding to claim benefits this year. Instead, they will be surprised by large refunds during the filing season next year.”

This means starting in January, the amount of withholding tax snatched away from worker paychecks will be lower next year, plus taxpayers can expect about $90 billion in refunds from the 2025 retroactive tax cuts.

We are not Keynesians and we don’t believe that giving people money to spend stimulates the economy, but letting people keep more of what they earn DOES encourage work, increase output, and juice consumer spending.

The average filer will save $1,000 on their taxes next year because of lower withholding taxes. Thank you, Donald Trump.