The debate rages on as to whether we are now in a secular era of persistent inflation, or whether Bidenflation is over thanks to eleven interest rate hikes by the Fed and a slowdown of M2 (money) growth.

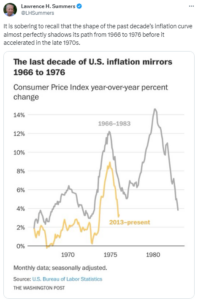

This chart from of all people — Larry Summers — is a useful cautionary reminder that during the inflationary decade of the 1970s inflation shot up and down like a yo-yo with periods of falling prices and sucker bear l-market stock rallies, only to be followed by the CPI yanked up again by high tax rates, a runaway federal budget, and Keynesian easy-money policies.

Twelve years of inflation was finally smothered by the Reagan-Volcker era of tight money, falling tax rates, and deregulation.

Past isn’t always a prelude. But if the 1970s and early 1980s teach us anything, it is that the solution to Bidenflation (just as was the case with Carter inflation) isn’t just higher interest rates. It’s growth policies that expand the supply side of goods and services.