Just as we predicted at the start of the year, inflation is STILL stubbornly stuck at a 4 to 4.5% annualized rate and all the happy talk on Wall Street about the death of Bidenflation was irrationally exuberant.

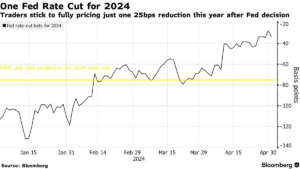

At the start of the year, the market was predicting five rate cuts in 2024. Now the expectation is one, as the chart below shows.

Fed chairman Jerome Powell would have been foolish to lower interest rates yesterday and flood more printed dollars into the economy under these conditions.

But we’re still concerned about his misdiagnosis of what’s going wrong and why inflation won’t go away. The Fed is STILL trapped in a “growth causes inflation” mentality. Powell declared that the current interest rate policy “is restrictive, and we believe, over time, it will be sufficiently restrictive.”

Huh? Restrictive of WHAT? Is the Fed TRYING to hold down the growth of the economy as a way to restrain price hikes? Is he happy the GDP grew at a measly 1.6% rate last quarter?

Our view on the economy is simple: we have way, way too much government growth and borrowing, and too little private sector growth. In the first quarter of this year, the federal government borrowed $500 billion! Most of the new jobs in the economy are government-dependent.

Why isn’t Powell shouting that out? The best way to restore prosperity and reduce consumer sticker shock is to put a federal restraining order on spending and keep tax rates low. Biden wants the opposite.

We’re starting to hear talk of the dreaded s-word: “stagflation” (low growth and sticky inflation). The current policy mix of runaway government spending, higher tax rates, and easy money is a sure way to get there. Just ask Jimmy Carter.