We mentioned in the hotline last week that venture capital funding was down by roughly 50% last year.

Now we learn from former World Bank President David Malpass, who heads up the CTUP economic advisory board, that banks are cutting their lending to businesses.

According to the most recent Federal Reserve data on the volume of bank lending at the end of 2023, the amount of money lent fell by $35 billion from the year before. But Malpass points out that if lending had simply grown at the inflation rate, we would have seen a $170 billion INCREASE. Hence, in real terms, bank loans were down by $205 billion.

We suspect there are two reasons for the bank’s caution. First, total core bank deposits – i.e., lendable money – were down by $1.1 trillion, or 6% last year.

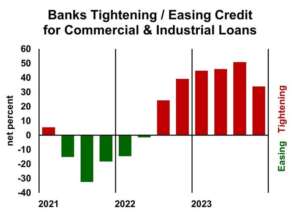

Second, is stricter bank credit standards – in part as a result of tighter regulations. One of those is the threat of new stricter capital requirements “Basel 3” imposed on banks. If banks are required to hold more reserves, by definition they have to loan out less money.

This loan shrinkage suffocates small businesses’ access to capital to grow and invest. It’s a worrisome forward-looking indicator for the economy.

Malpass on Maria Bartiroma: Where are the loans?