That’s what the Biden Treasury Department is saying.

We had to verify this was real when a reader sent it in, but alas, this report is on the Treasury Department website:

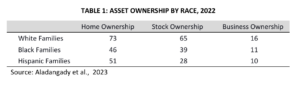

The heart of the study is this table:

Some lowlights:

Treasury found that most of the top tax expenditure categories disproportionately benefited White families relative to Black, Hispanic, and other racial/ethnic groups. One of the most salient results comes from how income from work is taxed differently than income from wealth…

Treasury estimated the benefit of this tax expenditure for preferentially lower rates on certain capital gain and qualified dividend income to be $146 billion for 2023 (U.S. Treasury, 2023) and that 92 percent of the benefits – $135 billion – accrued to White families…

The Administration’s Fiscal Year 2025 Budget proposes to increase the top marginal rate from 37 percent to 39.6 percent above $400,000, and it would apply this top marginal rate to the long-term capital gains and qualified dividends of taxpayers with taxable income of more than $1 million. An additional proposal would increase the net investment income tax rate by 1.2 percentage points on income above $400,000, bringing the net investment income tax rate to 5 percent for this population. Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.

As shown in a Treasury study, preferential tax rates on long-term capital gains disproportionately benefit White taxpayers.

Give them credit for honesty. Confiscatory, growth-crushing tax hikes on capital are terrible for economic growth and for government revenue – but they might be a good way to stick it to whitey.

This elevates racial politics to a new height of absurdity. We have to raise the top income tax rate and the capital gains tax – both of which will harm the U.S. economy – because it will punish whites more than blacks.

We have a better idea. Instead of making everyone poorer, by raising tax rates, why not EXPAND ownership to all households of all races?

Why don’t we democratize stock ownership – so everyone is an owner – by allowing workers to put their social security taxes into a 401k index fund plan rather than having it swallowed up in the mythical “trust fund”? Then EVERY worker in America would benefit from a lower capital gains tax. Over a lifetime, this would more than quadruple the wealth of whites, blacks, and Hispanics.