Nearly everyone we know and respect – including, most importantly, the guy in the White House – is desperately seeking a Fed interest rate cut. The idea here is that a Fed funds rate cut will kickstart faster growth and lower borrowing costs for mortgages, etc.

We would favor a small cut in the Federal Funds rate (certainly NOT 200 basis points), but we want to issue a warning flag.

Too many free marketeers and Wall Street traders think all we need to do is have Fed chief Jerome Powell lower the Fed Funds rate (as if he were a wizard behind the curtain) and then we can join hands, strike up the band, and start singing “happy days are here again.”

Here’s our problem with that logic. First, the market sets the interest rates (remember that old law of supply and demand for credit?) not the Fed. The Fed mostly follows the market interest rates that matter – it doesn’t set them.

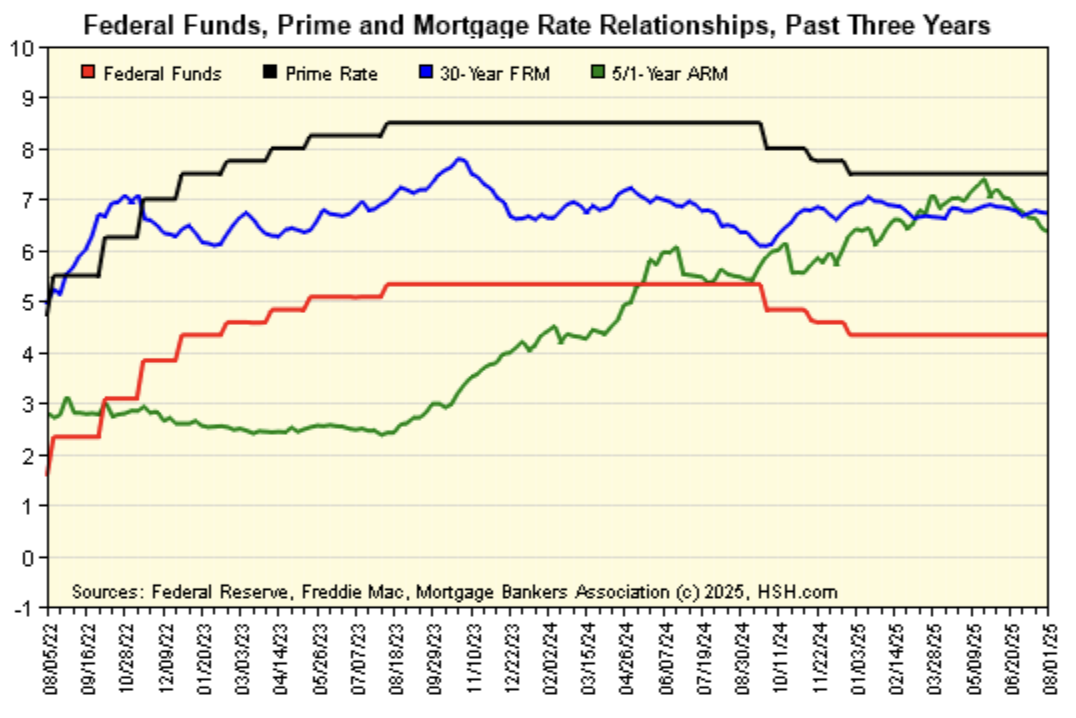

Second, if a Fed rate cut increases inflationary expectations by pumping excess dollar liquidity into the economy, this could RAISE rather than lower the 30-year mortgage rate. That’s what happened after the last round of Fed rate cuts in 2024. See chart. The red line is the Fed funds rate and the Green line is the mortgage rate. Inflationary expectations are the primary driver of long-term interest rates – not Jerome Powell.

Third, the one thing that could torpedo the Trump boom economy would be a resumption of inflation. Polls show that Americans are still angry about high grocery prices. If a rate cut increases prices, that’s bad for the country and really bad for the Right.

We just want the Fed to keep the dollar strong and stable.

So our warning is: be careful what you wish for.

We know a lot of our loyal readers will disagree with us, so please tell us why we’re wrong!

One last thing: the best way to stimulate the economy, jobs, and higher paychecks – and bring down long-term interest rates – is to CUT GOVERNMENT SPENDING!