Regular Hotline readers know that we’ve been more right on inflation than most prognosticators over the past several years. We predicted that the Biden $6 trillion spending spree would trigger inflation, and sure enough, the CPI surged to 9.2%. We’ve been forecasting for the past 18 months that the inflation rate would fall sharply by following the four forward-looking price and interest rate trends shown below. And so it has come to pass. Inflation has now fallen to 3.2% with no increase in prices in November.

The bad news is that prices are nearly 20% higher than in 2020. The good news is that as we continue to follow these lead indicators of inflation, we think it’s likely that the CPI is trending toward the two percent Fed target. Another Washington spending spree would likely send prices upward again.

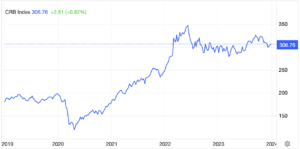

The CRB index of more than 20 commodities from coal to copper to wheat has fallen from a high of 350 in May of 2022 to 306 this week. We think the Fed should conduct monetary policy by keeping the CRB index at or around 300. Period.

Gold is the ultimate hedge against inflation. The Gold price climbed to $2,068 an ounce in percent days. That’s up about 10% this year, suggesting that investors still have lingering worries about inflation.

Interest rates on the Ten-year treasury bonds have fallen from 4.9% in October to 3.9% percent this week. This indicates declining investor worries about inflation.

The ten-year breakeven interest rate spread is 2.2% this week, which indicates that inflation worries have subsided over the past year. This 2.2% spread is only slightly higher than the Fed target rate of 2%.