There’s an old saying that Democrats love jobs but hate employers. That theme came shining through last night with Biden’s new tax assault against employers and “big business.”

The Biden plan is to:

-

-

- Raise the corporate tax rate to 28%, higher than Communist China.

- Impose a global corporate minimum tax of 21%.

- Nearly double the capital gains tax

- Quadruple the stock buyback tax (we told you it wouldn’t stay at 1%) which will undermine returns for all investors.

- Impose a new 25 percent tax on unrealized capital gains on “billionaires,” defined as anyone with a wealth of $100 million, which by our math is less than a billion.

-

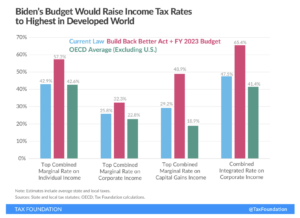

Biden’s Budget Would Raise Income Tax Rates

These tax hikes would pay for a massive expansion of welfare spending in the tax code with advanceable “child credit” monthly checks for non-taxpayers, increase the earned income credit, and give a permanent extension of supersized Obamacare subsidies.

The full plan is here: