We will get a new report on inflation on Wednesday this week which is likely to show year-over-year inflation still running at above 8%. That’s the really bad news.

But there is some good news. Regular readers know that we like to look at four forward-looking indicators of inflation. Good news. They are all pointing to a gradual fall in the inflation rate in the months ahead.

1 – Commodity prices:

The CRB index is still high, but down roughly 15% from its peak in June.

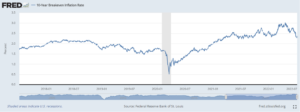

2 – The TIPS spread (which is the difference in the yields between U.S. Treasury bonds and Treasury Inflation-Protected Securities)

It peaked in April at 3% and is now at 2.4%.

3 – The price of gold

Gold has always been considered the ultimate hedge against inflation. It hit $1,860 an ounce in June and is now $1,765.

4 – The interest rate on the 30-year Treasury bond.

Not much movement. It was at 3.43% and is now slightly lower at 3.25%.

We expect that in the coming months the inflation rate will fall from 8.6% to the 5 to 6% range. Alas, that’s still well above the Fed target of 2%.

Inflation is coming down because demand is falling (in large part because of the recession) and because the Fed has begun to raise interest rates thus reducing monetary growth.

What took them so long?