Over the past 14 months, the Dow has been on a tear and so has the NASDAQ. Hooray.

But for start-ups and venture capital, the last two years have been an undertow.

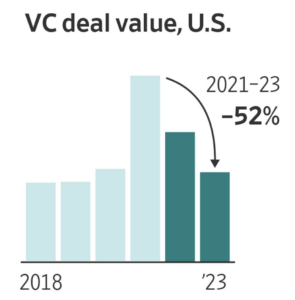

Between 2021 and 2023 VC funding of deals has taken a nose-dive – down 52% according to the Wall Street Journal. VC funding is the lifeblood for many startup companies moving beyond stage one funding raised typically from friend and family financing.

The number of major deals has also collapsed. The VC “deal count” for four of the largest VC firms has fallen by more than half – from nearly 700 in 2021 to about 300 last year.

WSJ claims that Fed interest rate cuts expected this year combined with the torrent of new AI-related start-ups will turn the tide. We’ll see.

But there’s a profound risk overhang right now in new startups, not mentioned by the media or the industry itself. IF Biden were to be reelected, next year taxes on capital gains could nearly double, and we could see the introduction of a new Biden wealth tax imposed on unrealized capital gains. He also wants to raise the highest income tax rate, which is paid by small business owners and partners. The evidence is overwhelming that capital gains taxes are HIGHLY negatively associated with VC funding.

Who wants to invest in risky ventures that could lose everything, when the government is threatening to snatch away up to 40% if there is any gain?