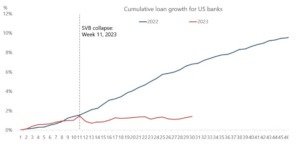

This chart forwarded to us by our friend and colleague John Catsimatidis of Red Apple Group shows a dangerous trend for the economy. Bank lending has slowed considerably this year (see red line) in the wake of the Fed’s 11 Interest rate hikes and the Silicon Valley Bank failure.

Meanwhile, the Fed reports that banks are tightening their lending standards as rates go higher.

Business conditions are good right now, so this may be just a blip. Or it could be the start of a trend that will choke off access to credit for small businesses as they try to expand.

One thing is for certain: this is the worst possible time for the Fed’s to be raising bank capital requirements, which would further constrain lending – so, naturally, that’s what the FDIC wants to do.