One of the unheralded victories in the tax bill that passed the House, is the expansion of federal dollars for school choice. As we previously reported, the bill creates a new scholarship tax credit.

It also smartly expands how tax-free 529 College Savings Plans can be used for expenses related to K-12 private school tuition and related expenses as well as vocational training.

This is a big deal because the savings stored in 529 plans have doubled to $501 billion and we want to divert some of that money away from subsidizing outrageous college tuitions.

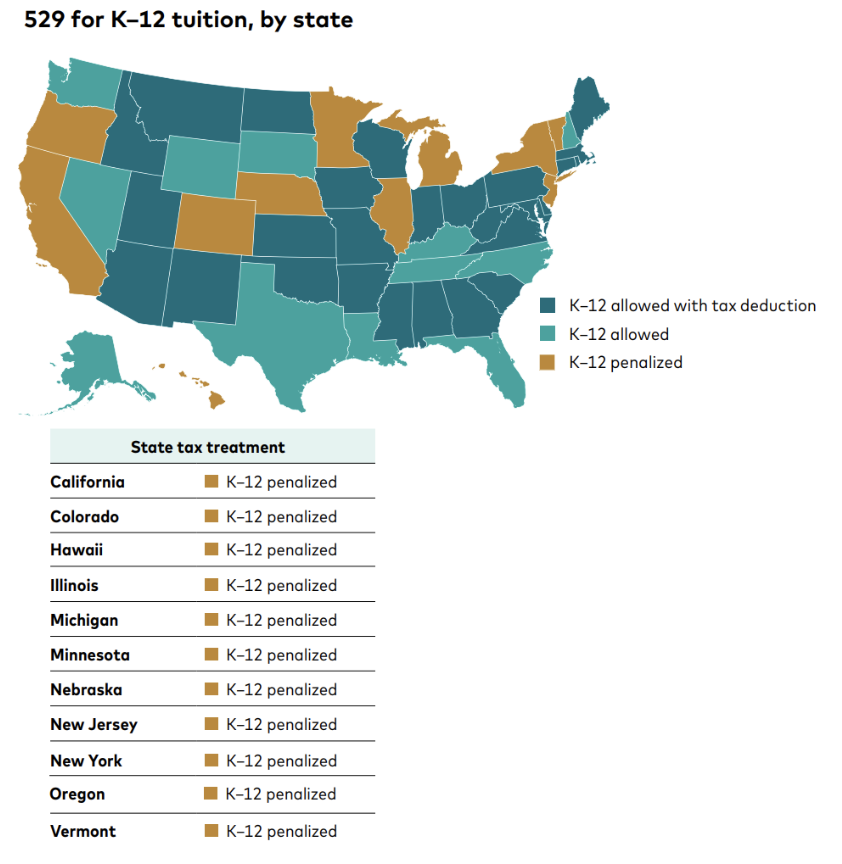

What is disheartening is that there are11 states that penalize 529 withdrawals used for private school K-12 tuition.

As the map below from Vanguard shows, all of these are deep blue states ruled by teacher unions – with one exception. What’s the matter with Nebraska?