The most recent Census data provides even further evidence that “soak the rich” tax policies are causing a blue states Meltdown. The three highest-tax states – California, New York, and Illinois – all lost the most population last year. Just a coincidence?

Democrats in blue state America say yes and have vowed to get out of the ditch by digging their financial holes deeper.

Vermont Democrats have just proposed yet another tax rate hike that would raise their highest rate to more than 8%. They’d move to having the 5th highest rates in the country. Pretty soon Ben and Jerry will be the only rich people left in the state.

Meanwhile, Maryland Democrats are pushing a “millionaire tax” ($750,000 in income and above), a capital gains tax rate higher than the regular income tax rate, and a new corporate tax.

https://www.washingtonpost.

California just effectively raised its top income tax rate to the highest in the USA – from 13.3% to 14.4% by uncapping the state’s 1.1% payroll tax. They must be so proud.

Washington, once an importer of talent and brainpower because of its no income tax status, just adopted a 7.5% capital gains tax and now Senate Democrats want a 1% annual tax on financial intangible assets.

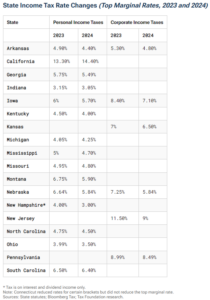

Meanwhile, in 2023, eight red states — Arkansas, Indiana, Kentucky, Montana, Nebraska, North Dakota, Utah, and West Virginia — enacted policies to reduce personal or corporate income tax rates. Oklahoma is set to cut rates this year to as low as 2%. Several of these states now have flat taxes, not multiple-tier “progressive” rates. Every state on this list is a red state except Connecticut.

These new taxes will only make the yawning gap between red states and blue states wider. If you live in a red state: More blue staters are coming.