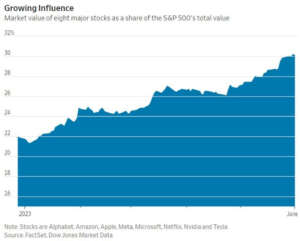

We don’t like the left-leaning politics of the tech companies, but we LOVE how much money they are making for American shareholders. As the chart below shows, eight firms – Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Tesla, and Nvidia – now make up 30% of the S&P 500’s market capitalization, up from 22% at the start of the year. Is the fact that they are making money for 150 million American shareholders a reason to break them up as “monopolies?”

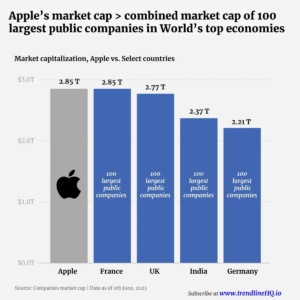

Then there is Apple. According to Maverick Equity Research, Apple’s market capitalization surpasses not only the Russel 2000 index (comprising US small-cap stocks) but also exceeds the combined market capitalization of the 100 largest publicly traded companies in France, the UK, India, Germany, and Canada.

Now you know why the Brits and the Europeans want to attack the dominant U.S. high-tech companies with lawsuits, tariffs, antitrust complaints, and so on.

But why are Lina Khan and the U.S. Federal Trade Commission – and too many Republicans in Congress – trying to aid and abet our foreign rivals with spurious and antitrust allegations? Tech prices are falling, they aren’t rising.