One important way the Senate can improve the House-passed Big Beautiful tax bill would be to include the REINS Act.

This would stop major new regulations, unless they are individually approved by majorities of the House and Senate. This de facto regulatory freeze would dramatically improve business conditions and would, according to the Heritage Foundation, reduce the deficit by north of $1 trillion over 10 years – enough to pay for lowering the corporate tax rate to 15%.

REINS disappeared from the House bill on the night of final passage due to concerns that Senate budget rules could strike it down. But Senate Majority Leader John Thune has told us that there is still a chance to revive REINS, and he promises he’s going to do “everything possible to have it included” in the final bill.

That’s great news. Here’s why it matters.

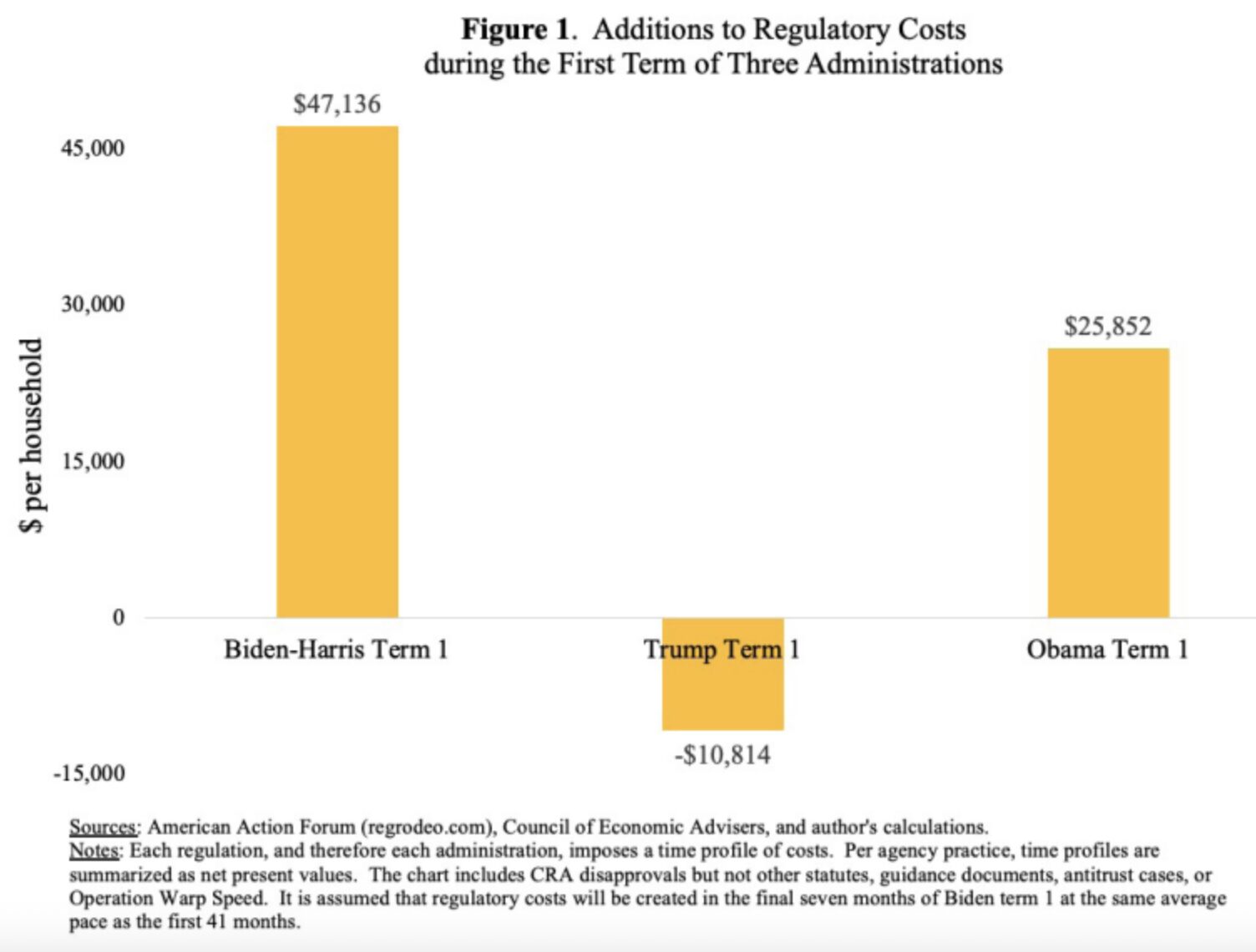

An analysis for UP by Casey Mulligan (whose nomination to be Trump’s deregulation czar at the Small Business Administration is still waiting for Senate approval) found that while Trump’s first term was net deregulatory, Biden was the new world champion of overregulation, nearly doubling Obama’s previous record:

With REINS, every bad regulatory idea would be permanently on ice unless and until it could actually command majority support in Congress. This would be the biggest deregulation in American history.

Just do it.