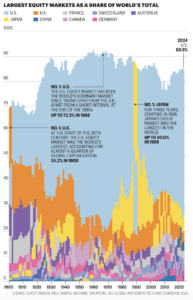

This Fortune chart shows the performance of the U.S. stock market measured against the world’s other major markets. America’s share of the total world market cap is shown in blue. This reinforces a point we continually make in the HOTLINE: U.S. companies are so completely dominant that their market valuation is more than the value of every other nation in the world – combined.

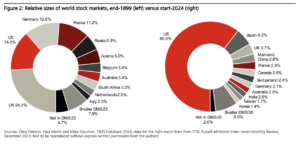

Here are the numbers on each country’s contribution to global market capacity and notice the meteoric rise in wealth in the U.S. versus other nations.

What’s amazing is that at one point in the late 1980s, Japanese companies were worth more than all the publicly traded companies in the U.S.

That was when American economists like Lester Thurow, declared that the U.S. had to adopt a national industrial policy (NIP) to keep up with the Japanese. Thankfully under Reagan, we cut tax rates and deregulated.

Today, USA Inc. is worth many multiples more than Japan Inc.

Meanwhile, China adopted some free market principles in the 1990s and early 2000s and was rapidly catching up with the U.S. But in the last 15 years, China Inc. has flatlined. Sorry, President Xi. That’s the price you pay for going socialist/communist.

Much of the rise here at home, is due to the complete American global dominance in the tech industries (So naturally, fools like Lina Khan of the FTC and some politicians on the right and the left want to slice them up and slow them down for being TOO profitable). But the U.S. is also blowing away the competition in retail, financial services, and entertainment.