Joe Biden keeps saying that our 8 to 9 percent inflation. Isn’t his fault because runaway prices are a “global phenomenon.” That’s not exactly true because there is no inflation in Japan (3%), for example, and there at five major industrial countries that have inflation rates LOWER than ours – including France, Korea, India, and Australia.

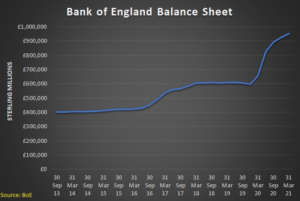

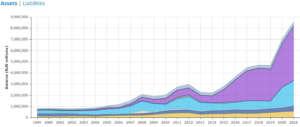

But it is true that nearly all of the major central banks around the world have flooded their economies with money hot off the printing presses. Notice the similarity in the three charts below. The U.S. Federal Reserve Board, the European Central Bank and the Bank of England have all massively ramped up their balance sheets by purchasing assets, which pumps inflationary money into the economy.

Why did they do it? To accommodate some $20 trillion of public spending and borrowing over the past two and a half years – an unprecedented expansion of government.

In short, central banks have been partners in crime with the politicians in the global debt and inflation crisis.

As economist Dan Mitchell puts it:” The European Central Bank made the same mistake as the Fed. It panicked at the start of the pandemic and then never fixed its mistake.”

He’s right. Worse, they continue to facilitate even more public spending and debt at a time when governments should be reversing course and paying down their enormous liabilities. Biden in just his first two years in office has ADDED $1 trillion in new debt spending with $4 trillion more baked into the cake through 2030.

To get back to a high-growth, low-inflation economy, the U.S. and other nations must 1) cut trillions of dollars and Euros of government spending and 2) Central Banks must start to drain their balance sheets, which will pull inflationary money out of the economy. This has to happen NOW or we are at risk of 1970s-style stagflation where savings, wealth, and incomes got crushed under the steamroller of big government.

The Fed Balance Sheet

The European Central Bank Balance Sheet

The Bank of England Balance Sheet